Can Self-Storage Get You to Retirement? Investigate This 10-Year Comparison and See

There are lots of financial strategies designed to create wealth and build a nest egg toward retirement, but does it make sense to think about self-storage in that context? Here’s a 10-year comparison between giving money to a wealth adviser, investing in an S&P index fund and building a small self-storage facility. Which do you think offers the best expected return?

May 12, 2023

I’m not an investment adviser and don’t want to be; however, as a self-storage owner and investor, I do believe this business can be leveraged as a vehicle to provide financial stability toward retirement. After all, it’s the path I’ve taken.

Need convincing? I thought it would be valuable to run numbers for three different investment scenarios, not only to see how they compare but to demonstrate how self-storage can be a superior conduit for amassing wealth. The options we’ll examine are giving your money to an investment adviser, investing in a Standard & Poor’s (S&P) 500 index fund and building a small self-storage facility. You’ll notice I’ve used the same starting figure for all three examples and incorporated today’s high construction costs. Let’s take a look, and then you decide.

Self-Storage Advantages

Let me preface this exercise by explaining why I love self-storage as an alternative investment. First, the industry has proven itself to be recession-resistant. Though this statement is based on past performance with no guarantee that it’ll be replicated in the future, the odds are good that self-storage will continue to outperform stocks and other real estate markets during economic downturns. Even in “normal” cycles, it’s easier to increase earnings with this asset type than any other income-producing real estate I’ve seen.

Second, the ongoing capital required to sustain a self-storage investment and keep cash flow growing is minimal. Remember, our buildings are essentially steel walls and a concrete floor that generate apartment-like rent. When institutional lenders like commercial mortgage-backed securities require us to set up reserve funds for capital expenses, they generally only mandate 12 to 15 cents per year.

Finally, once a self-storage facility is stabilized (85% to 90% occupied), it’s rare, if ever, that it becomes unprofitable. Though I’m sure it’s happened somewhere, I’ve never personally experienced it and don’t know anyone who has.

Investment Premise

Now, back to our exercise, which is designed to help us compare the internal rate of return (IRR) of three investment types over 10 years. This is a useful metric when you’re trying to compare self-storage against something like mutual funds, which is where many wealth advisers would place your money, along with bonds.

For all three of the following examples, our starting figure is $651,250. I chose this because it’s a realistic 25% down payment for our self-storage development scenario. Using the same amount as our starting figure across the board allows us to draw valid comparisons for cash flow after 10 years, including getting our initial investment back as well as any profit.

Just keep in mind that self-storage operation requires specialized knowledge. I’ve left plenty of room in our operating expenses to accommodate third-party management, but be aware that any investment in this industry requires more direct participation from the owner than the other two options (turning over your money to an adviser or buying index funds).

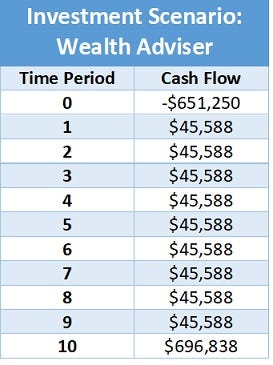

Example 1: Wealth Adviser

In our first example, an investment adviser takes our $651,250 and yields an average net of 7% cash flow. To be clear, this percentage grants some leeway and benefit of doubt, as I’ve never had or known an investment adviser to quote an average 7% income yield. For our purposes, that number is the net after adviser and mutual-fund fees (good luck finding that in the real world). Based on this scenario, below is what the cash flow would look like.

The table starts at Year 0, which is when our investment begins. Our cash flow is initially a negative number because we’re putting in that money to start.

Another way to look at the IRR of 7% is that our investment averaged 7% per year over the 10 years it was in this vehicle. The primary benefit this option has over the other two is it takes no effort on our part—other than hoping our adviser doesn’t lose any of our initial outlay.

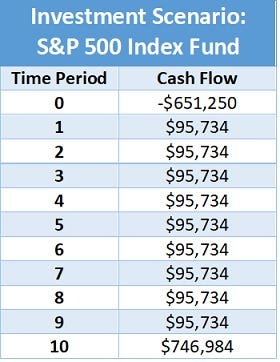

Example 2: S&P 500 Index Fund

Next, let’s say we decide to invest in a low-fee, S&P index fund. In this scenario, there’s no fund manager buying and selling stocks; we simply own the S&P. In reality, these funds outperform most mutual-fund managers and advisers.

From 1985 to 2015, the S&P 500 averaged an annual 10.3% return. Over the last decade, with the economy expanding through most of it, it averaged 14.7% per year. Though I doubt the next 10 years will keep pace, let’s use the high average for the sake of our comparison. The cash flows would be:

In this case, you do nothing but let your investment ride and wind up with $746,984. The table assumes an average return of 14.7%, but in reality, annual cash flow would vary with market fluctuations. A higher early return could improve performance (the earlier the money comes in, the better impact it has on IRR), but for our calculations, it’s easier to use an average return per year.

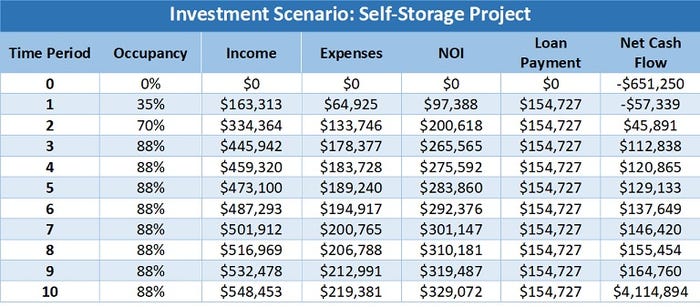

Example 3: Self-Storage Development

Now let’s look at the self-storage scenario. In this case, we’re building a traditional, 35,000-square-foot facility with drive-up units. We’re paying $400,000 for the land and $63 per square foot for construction for a total project cost of $2,605,000. We’re assuming a 25% cash down payment of $651,250 to finance the project. I can actually build this today, or get close to it, in many markets. (Incidentally, if this was an acquisition of a newly constructed facility in the beginning of lease-up, an equal scenario would work out to $74.43 per square foot.)

Now, let’s assume our income per square foot is an average of $13.25, and our operating expenses are 40%. It’ll take a while to lease up to an average occupancy of 88%, but when we get there, our numbers will look something like this:

Gross potential income: $463,750

Net income: $408,100

Operating expenses: $163,240

Net operating income (NOI): $244,860

Value at a 7% capitalization (cap) rate: $3,498,000

One of the many benefits of a self-storage investment is income typically goes up each year. In my own portfolio, I averaged more than 6% annual income growth from 2012 to 2019. My operating expenses rose about 3% per year, so my average NOI increase was around 3%. For this example, let’s say our income goes up 3% annually while operating expenses remain at 40%.

Finally, here are the assumptions on our $1,953,750 bank loan:

Term: 20 years

Interest rate: 5%

Annual debt service: $154,727

Time to stabilization: 3 years

Occupancy:

Year 1: 35%

Year 2: 70%

Year 3: 88%

Based on these assumptions, the cash flow for this project would look like this:

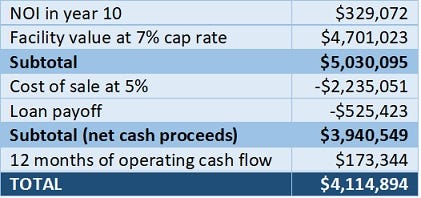

Our 10-year figure includes 12 months of operating cash flow at $174,344, plus the net proceeds of selling the facility at a 7% cap rate. Here are the calculations:

The resulting IRR comes out to 25.9%, compared to the assumed 14.7% IRR in the low-fee, index-fund example. That’s a significantly higher net yield.

In the End…

While self-storage offers the highest payout of our three investment examples, again, it takes more than just your money to be successful. It requires you to learn a business. Is it worth it? Only you can decide what’s right for your situation and risk tolerance.

It’s my hope that this article will spur you to research and explore potential retirement strategies that could allow you to take control of your financial future. I woke up in my 50s and realized that if I was going to be able to retire, I had to act quickly. Today I work because I want to. Self-storage was the vehicle that created fiscal stability for me and my family. See you on the golf course!

Mark Helm is a commercial real estate agent and self-storage investor. He began working with real estate investment trusts in the mid-1990s to locate and purchase self-storage properties before striking out on his own. He’s the author of “Creating Wealth Through Self-Storage” and the creator of “Storage World Analyzer,” a cloud-based, financial-analysis software tool designed to help self-storage operators and investors evaluate potential real estate acquisitions or development projects. To reach him, email [email protected].

About the Author(s)

You May Also Like