After attending the Self Storage Expo Asia in Bangkok, a U.S. self-storage veteran walked away with a fresh perspective on the local industry. Here’s her take on the emerging market’s challenges and achievements.

February 5, 2019

Knowing the population of Asian countries to be the highest in the world, you might expect self-storage would take off in these markets and experience explosive growth. This is true in some areas, but not all. It’s a truly diverse assembly of nations and cultures.

The Asia self-storage market is also dealing with some dynamics that were never faced by U.S. industry professionals. For example, a devastating fire at a Hong Kong facility in 2016 has led to extremely regulated conditions. As a result, some stores have closed, and year-over-year growth is down in number of facilities and overall square footage. This is just one of the obstacles the local business faces.

After attending the Self Storage Expo Asia in Bangkok in May, I came away with a fresh perspective of this emerging market. Here’s a quick overview of the industry and my observations of its challenges and achievements.

By the Numbers

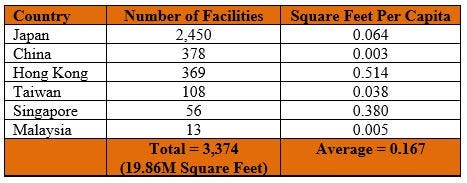

Below is a summary of the Asian self-storage market, based on survey conducted this year by Self Storage Association Asia (SSAA) and Ipsos Business Consulting. Association members receive the full results, which contains more data and trends than I’ve shared here. It’s invaluable to collect and disseminate this information and support smart growth and standards for a growing industry. The SSAA is to be congratulated on its ability to provide such a valuable tool.

Average occupancy in the region is 76.5 percent. Monthly rents per square foot range from $2.05 in Malaysia to $6.25 in Hong Kong, so it’s easy to see there’s limited competition. As the years pass and new operations are established, rents will no doubt fluctuate as they have in other international markets. According to the survey, roughly 54 percent of Asia operators plan to expand their business in the core markets in which they currently operate.

Mainland China showed the best performance in the 2018 survey, with an impressive 122 percent year-over-year growth (from 170 to 378 facilities). As Asia's leading market, Japan reported a slow but steady 8.9 percent growth, which was consistent with the last eight years of 8 percent to 10 percent growth.

Industry Challenges

According to the survey, the top five challenges faced by Asian self-storage operators are:

Government compliance

Suitability of available space

The high cost of converting an existing building to self-storage

High startup costs

Availability of space to build

Local operators also face the challenge of industry awareness. The key to growing a customer base in new markets is educating the populace about the product, including benefits to consumers and small businesses and how self-storage differs from warehousing or other more traditional storage methods. Asia’s operators need inexpensive but highly effective means to tell their story and grab consumers’ attention.

The industry associations can lead the various countries in establishing laws that determine how self-storage is leased and governed. This will be challenging in such diverse cultures, but it’s easy to see how monumental these issues will be to the success of the industry.

Expansion

Operators in this region of the world will likely continue to expand and have plenty of room to grow. One would expect to see a rising sophistication in their operations as they complete the education portion of the development curve and move into refinement of management and customer-service programs.

As in many other self-storage markets of the world, there will be pioneers in Asia willing to set the stage and endure the learning curve, applying technology to enhance the business and teach the population, then graduating to a more state-of-the-art product, using differentiation of service and amenities to exceed customer expectations and grow brand loyalty. Some will choose to sell on price alone as they have done in the U.S., while others will aim to attract “the cream of the crop” through more upscale offerings. The great news is there’ll be room for everyone willing to fight through the challenges of these formative years.

M. Anne Ballard is president of training, marketing and developmental services for Universal Storage Group and the founder of Universal Management Co. She’s past president of the Georgia Self Storage Association and has served on the national Self Storage Association’s board of directors. She’s also participated in the planning, design and operation of numerous storage facilities. For more information, call 770.801.1888; visit www.universalstoragegroup.com.

About the Author(s)

You May Also Like