A Step-By-Step Guide to Self-Storage Taxes, Cost Segregation and Cash Flow

Doing your self-storage business taxes can be daunting, but with some strategic planning, the payoff can be rewarding. Learn how cost segregation can help you save thousands of dollars and increase cash flow.

Tax season is daunting for everyone, particularly self-storage owners who have anxiety about it. After gathering receipts, tracking costs and verifying all your income, you’re presented with that final number. You may be shocked at having to write a big check to the Internal Revenue Service or completely relieved that you’re due a refund. Either way, the process is cumbersome and often left in the hands of a trusted certified public accountant (CPA).

Still, the U.S. tax code is extremely complex, and expecting a CPA to understand every nuance would be like expecting your family doctor to perform knee-replacement surgery. Most CPAs have significant knowledge on the broad spectrum of personal and corporate tax filings, but they may not be aware of some strategic planning that can drastically reduce your tax liability and create retroactive refunds for extra cash flow. Here’s a guide to better understanding your self-storage taxes and how you can potentially save thousands of dollars through cost segregation.

First, Know Your Tax Rate

Do you know what your effective tax rate is? It’s the total percentage of income tax you pay. To figure it out, take your total tax (line 63 on Form 1040) and add your state tax (if applicable). Next, divide that number by your adjusted gross income (line 37 on Form 1040). The decimal amount multiplied by 100 will give you your average federal tax rate. Most taxpayers fall between 25 percent and 45 percent. For every $200,000 at 30 percent, you’ll owe $60,000 in income tax.

Identify Your Depreciation Method

Depreciation is an asset’s reduction in value with the passage of time, due to wear and tear. The asset is allocated over a specific period during which it’s expected to be useful. Commercial real estate, including self-storage, has a useful period of 39 years, while land improvements such as asphalt, parking, landscape and security fences have a useful allocation of 15 years, according to the IRS. Land is considered to be an asset that doesn’t devalue over time.

Standard accounting principles offer three options for depreciating real estate. For our purposes, we’ll focus on two:

Straight-line depreciation: This takes your entire building and depreciates it evenly over 39 years.

Modified accelerated cost-recovery systems (MACRS): This method treats different parts of a building as individual assets, such as the roof, concrete, asphalt, carpet, appliances, doors, signage, etc. These may be depreciated over five, seven, 15 or 39 years.

Consider Cost Segregation

Many self-storage owners and investors are familiar with the term “cost segregation” but may not know if they can take advantage of it. You might be eligible for valuable cost savings!

Cost segregation (seg) is a federal tax tool and strategic tax-reduction vehicle that uses MACRS to accelerate the timetable for property-depreciation deductions. A cost-seg study is used to determine depreciation schedules by identifying and reclassifying personal-property assets to shorten depreciation time. Under the guidance of engineering and tax professionals, it will identify real property assets along with which portion of those costs can be treated as real property for accelerated depreciation. The Tax Cuts and Jobs Act (TCJA) of 2017 included provisions that greatly enhanced the benefits of these studies.

Cost segregation reduces taxable income and increases cash flow by identifying personal property vs. real property. It also identifies individual building components for tax purposes, rather than treating a building as one large asset. This determination allows owners to depreciate assets over their useful life instead of assuming the entire purchase amount applies to one long-term holding.

Under MACRS, assets are identified and reclassified in five-, 15- and 39-year class lives, depending on the IRS determination of their actual useful life. Here are some examples:

39-year property: Windows, walls, doors, roofs, HVAC systems, plumbing, electrical

15-year property: Exterior improvements such as fencing, exterior signage, asphalt, curbs, landscaping, exterior lighting

Five-year property: Carpeting, appliances, specialty lighting, woodwork, unit partitions, individual unit locks, security, business-specific heating and ventilation systems

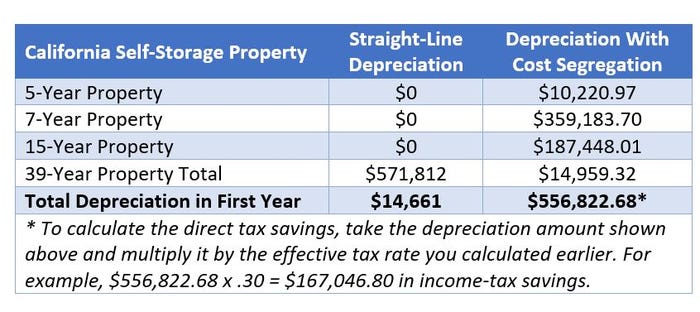

Cost segregation allows you to retain additional cash flow for capital improvements, repairs or expansion. Self-storage operators can benefit significantly from using it because of the unique types of construction and exterior improvements found on a storage site. The following table shows the drastic depreciation increase when cost segregation is applied vs. straight-line depreciation. What if your tax bill is lower? Any unused depreciation amounts carry forward until they’re used up.

Understand Bonus Depreciation

Bonus depreciation (cost segregation on steroids) allows an immediate first-year deduction on a percentage of eligible business property. Under the TCJA, it was expanded to 100 percent for qualified property that’s placed in service after Sept. 27, 2017, and before Jan. 1, 2023. Further, the TCJA made it possible for used property to be considered for bonus depreciation. (Previously only “original use” property qualified.) After 2023, the bonus-depreciation provisions will be phased out in 20 percent increments until 2027, and then go away completely.

Tangible personal property with a recovery period of 20 years or less also qualifies for bonus depreciation under the new law. Components of purchased buildings can qualify, too. A cost-seg study will examine the qualified property you can deduct at the 100 percent rate. The components that qualify for bonus depreciation (i.e., immediate expensing) are items like carpeting, appliances, movable buildings, security fencing, landscape, asphalt, exterior signage, etc. This could get more than $300,000 in first-year deductions on a $1 million purchase!

Explore Energy-Efficient Incentives

Another useful strategy is to take advantage of the Energy-Efficient Commercial Buildings Tax Deduction (179D), which applies to assets like HVAC, building envelope or lighting for climate-controlled units. 179D deductions can be taken for new construction as well as retrofits, but you must be able to reduce total annual energy and power costs by 50 percent compared to a sample building from 2007. Partial deductions are allowed.

The maximum deduction is $1.80 per square foot. Partial deductions of $0.60 per square foot/per system are allowed for the reduction of energy consumption through the building envelope, HVAC or lighting. Finally, a partial deduction for interim lighting is allowed.

Know the Benefits of the CARES Act

In March, Congress approved a sweeping $2 trillion stimulus package in response to the coronavirus pandemic. The Coronavirus Aid, Relief and Economic Security (CARES) Act provides much needed assistance to individuals and businesses hurt by the struggling economy. It includes several improvements to cost segregation and other tax changes that benefit tax credits and the treatment of business losses. These include:

Bonus depreciation and net operating loss (NOL): In addition to the 100 percent bonus depreciation described above, CARES includes a new, five-year carryback option. An NOL from 2018, 2019 and 2020 can now be carried back to generate refunds and remove taxable income limitation. The former NOL limit of 80 percent of taxable income is suspended, allowing NOLs to fully offset income in current taxable years. For this reason, it’s important to review all cost-segregation opportunities. Taxpayers should also look at 179 and 179D opportunities to generate an NOL and possible refunds.

Excess business loss carryback: The CARES Act also resolves the excess business-loss limitation ($500,000 cap) applicable to pass-through business owners and sole proprietors for taxable years beginning in 2018, 2019 and 2020. This allows businesses to benefit from the modified NOL carryback rules.

Alternative minimum tax (AMT) credits: CARES also provides temporary relief from TCJA provisions that imposed limitations on the use of AMT credits. It accelerates the timetable for companies to claim refundable credits to help with cash flow during the pandemic.

The CARES Act includes numerous individual and business tax provisions. Consult with your tax adviser on the best strategy for your self-storage operation.

Though taxes can be overwhelming, cost segregation can be well worth the effort. Find a reputable adviser who’s familiar with the self-storage industry. He can ensure you don’t leave money on the table and that your tax filings meet all IRS requirements.

Heidi Henderson is executive vice president of Engineered Tax Services, a licensed engineering firm focused on specialty tax services relating to federal tax incentives and strategies for real estate owners. She has more than 25 years of tax and accounting experience in the real estate finance, development, construction and commercial property sectors. To reach her, call 801.689.0325; e-mail [email protected]; visit www.engineeredtaxservices.com.

About the Author(s)

You May Also Like