Japanese Self-Storage: 'Trunk Room' Market Growing Steadily

Although there is no reliable historical data regarding the size and growth of the Japanese self-storage market, a recent supply survey conducted by Quraz, Japan's largest self-storage operator, estimates the market at approximately $300 million and growing at approximately 10 percent per year.

January 2, 2013

By Steve Spohn

Whenever I introduce Japanese self-storage to overseas operators, I find it useful to highlight some of the differences between self-storage in Japan and the United States. One of the most obvious distinctions is the name.

In most countries, the product is referred to as self-storage or mini-storage." In Japan, it has multiple names, including trunk room (borrowed from the English) and kashi soko and rental soko, both of which translate to "rental storage." Trunk room is the most commonly used.

Trunk rooms first appeared in Japan in the 1970s. At that time, they were generally offered by warehouse operators and were, in fact, little more than a warehouse service for consumers. The operator took possession of and was responsible for a customer's personal property, and the customer was given a receipt for his "deposit." The operator was subject to and regulated by modified warehousing laws. These early trunk rooms never gained significant traction, likely due to the industrial nature and inconvenience of the product.

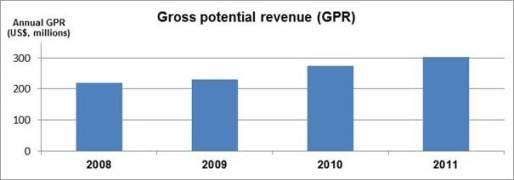

In the 1990s, regulated trunk rooms eventually gave way to a more customer-friendly and unregulated product similar to self-storage in other parts of the world. Although there is no reliable historical data regarding the size and growth of the Japanese market, a recent supply survey conducted by Quraz, Japan's largest self-storage operator, estimates the market at approximately JPN ¥24 billion, or approximately US $300 million, and growing at approximately 10 percent per year.

The Japanese self-storage market likely ranks fifth in the world behind the United States, Canada, Australia and the United Kingdom, respectively. Based on third-party research commissioned by Quraz in 2009, if the market continues to grow by 10 percent per year and ultimately reaches 5 percent penetration among the top 15 cities, or 2 percent penetration nationwide, it will grow to US $2.1 billion over the next 20 years. (Penetration compares the number of storage units to the number of households. A 5 percent penetration means there are five storage units per 100 households.) In comparison, the U.S. market is approximately US $22 billion, with approximately 10 percent penetration nationwide, according to the U.S. national Self Storage Association.

The driver of this expected growth is simply an increase in awareness of the modern trunk-room service. Only about 15 percent of the Japanese public has used self-storage or knows the service well, based on local penetration and awareness research commissioned by Quraz in 2008 and a 2011 research report produced by the Yano Research Institute. Although many consumers may claim to know of the trunk-room concept, most neither know the benefits of the product nor can identify the primary reasons to use it.

Key Growth Challenges

The two biggest strategic challenges in growing Japanese trunk-room businesses are sourcing and financing. First, real estate is much more expensive in Japan than the United States. Compounding this dynamic for trunk-room operators is facilities must generally be located in dense, urban and more expensive areas because many Japanese dont have cars. They would access the business by foot, bike or train.

On a fully built-out basis (or rather, a fully converted basis, as most trunk-room locations are conversions from office space), Japanese storage costs the developer about $350 to $450 per gross square foot, including the purchase price and conversion, based on statistics provided by Quraz. In the United States, it costs $50 to $75 per gross square foot, according to information compiled and estimated from the U.S. self-storage real estate investment trusts. This challenge is difficult to overcome, but hard work and discipline helphard work to build a deep pipeline of opportunities, and discipline to wait for the right opportunities or for sellers to become more motivated.

The other strategic growth challenge is the availability of financing. To the best of my knowledge, non-recourse financing has not been available for trunk-room assets in Japan. Domestic banks have yet to invest the time to understand and embrace the trunk-room asset class, for several reasons:

The asset class is relatively new.

A trunk-room asset has yet to trade hands.

There are few institution-grade operators in Japan.

Domestic Japanese banks are very conservative.

This challenge will likely be overcome with time. Specifically, domestic banks may be forced to support trunk-room transactions if and when:

One of their large customers, such as a multi-national trading company, buys or launches a trunk-room business.

Offshore banks, insurance companies or financing companies, many of whom have successfully financed storage in other parts of the world, begin financing and enjoying the benefits of trunk room assets.

New, credible operators enter the market and bring with them a level of sophistication and know-how that adds to the credibility of the asset class and provides alternative operators in the event of trunk-room borrowers default.

My company is bullish that these strategic challenges will ultimately be overcome with time, effort and imagination. I also imagine the Japanese trunk-room market will eventually and naturally take its place as the second or third largest self-storage market in the world, the same position as the Japanese economy relative to other world economies.

Steve Spohn is the president of Quraz, Japans largest owner and operator of indoor self-storage facilities. Spohn has been living and working in Tokyo for nearly five years. He can be contacted at [email protected]; visit www.quraz.com .

You May Also Like