Self-Storage Market Analysis 2021: Baltimore/Washington, D.C.

The Baltimore/Washington, D.C. area is often considered a single market, but when it comes to self-storage, there are clear distinctions between the cities. Read why both continue to draw investor interest, despite surges in new supply and the effects of COVID-19.

Separated by only 40 miles, Baltimore and Washington, D.C. are often treated as one giant metropolitan area. While that’s understandable, when it comes to self-storage, there are clear distinctions between the two cities. For example, Baltimore is experiencing a distinct slowdown in new construction, while D.C. continues to see a strong increase in self-storage supply.

“They’re really different markets with an overlap in the middle,” says Gaby Sader, a partner and executive vice president with Boardwalk Storage Solutions, a developer that specializes in self-storage in the region.

Washington D.C.

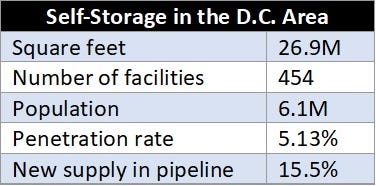

In the D.C. area, which includes the suburbs of Southern Maryland and Northern Virginia, the self-storage market continues to draw investor interest, with new projects expected to expand overall supply by 6.7 percent, according to Cory Sylvester, a principal at Radius+, which specializes in data, analytics and location intelligence for the self-storage industry. New construction has been intense in the core city, and even the suburbs have seen strong activity.

The region has experienced a three-year supply growth of 15.5 percent. “That’s definitely high,” notes Sylvester. “Washington has been going strong now for a while.” Todd Manganaro, president of the Maryland Self Storage Association and CEO of ezStorage, which owns about 50 self-storage facilities in the Baltimore/D.C. area, feels the area has definitely been overbuilt.

Overall, new supply has had a negative impact on rental rates, driving prices for 10-by-10, climate-controlled units from around $160 in September 2017 to $145 in February 2020. During the depths of the coronavirus pandemic this past spring, prices sank as low as $125, but they’ve since bounced back to around $165, according to Radius+. D.C. is a dynamic, growing city with a solid, federal employment base and an expanding high-tech sector, all of which drives recovery.

Despite all the new construction, the region’s self-storage penetration rate—the amount of space being used per capita—remains at about 5.13 percent, below the national average of 5.8 percent. This continues to make D.C. an attractive market for investors.

Other factors lending to its allure are continued population growth and increases in household income. D.C. and the surrounding metro areas have become highly desirable places to live and work. Prices for residential real estate are very high in the district, which leads to fantastic long-term stabilization and rent growth. But those prices also correlate to high real estate taxes, one of the few negatives of the market. Difficult zoning restrictions are another potential challenge.

Baltimore

As for the considerably smaller Baltimore area, the market’s image has been banged up in recent years. The city is often portrayed as a hotbed of criminal activity (think about the HBO drama, “The Wire”).

Chris Brandaleone, CEO of RightAway Storage, is among those who believe this impoverished identity is unfair. Baltimore actually has a large population of young professionals who live in renovated, upscale, multi-family buildings. This group also tends to be comprised of transient professionals who often need self-storage. Economic data backs up the assertion that Baltimore is a stronger, more dynamic market than what’s portrayed in the media.

As for self-storage activity, the city saw a 14.6 percent increase in supply over the past three years, according to Radius+. The penetration rate is 5.27 percent. Still, recent construction has taken a toll, with prices for 10-by-10, climate-controlled units falling from about $135 per month in September 2016 to $120 in February 2020. Prices plunged in the spring to around $105 per unit but had rebounded to about $130 as of mid-September. Building activity ground to a halt, with new construction expected to add only .9 percent to the area’s overall self-storage supply.

All in all, Baltimore’s dense population and location—smack dab in the middle of the Eastern seaboard—leave it well-positioned to weather short-term volatility and provide long-term, stable returns to investors. Brandaleone believes its long-term fundamentals are strong. In fact, RightAway is building a 110,000-square-foot facility in Baltimore County, just outside the city.

In terms of market negatives, high real estate taxes are among the biggest drawbacks. Though lease-up for new facilities may take longer than hoped, the investment will be worthwhile in the long run, Brandaleone says.

Patience Pays

Though both markets have experienced overbuilding in recent years, Baltimore and Washington D.C. remain attractive for investors who are willing to be careful and patient, according to Noah Mehrkam, CEO of Self Storage Plus, which manages 42 facilities in the area. “It’s harder to find good sites these days compared to seven or eight years ago, but we’re going to keep looking for good micro-markets. You have to be prepared for the long-term slog.”

You can bet investors are actively seeking institutional-grade opportunities in both markets.

William “Bill” Sitar Jr. is vice president of Sitar Realty Co. and The Storage Acquisition Group, which specializes in acquiring off-market self-storage facilities and portfolios nationwide. The company also offers market-analysis reports, underwriting and closing support. Bill has a background in real estate brokerage, legal services, development and the financial sector. He holds a real estate license in New Jersey and a law license in New Jersey and Pennsylvania.

About the Author(s)

You May Also Like