Clearing Up the Confusion of the Cap Rate: What It Is and How It’s Used in the Self-Storage Industry

Capitalization (cap) rates are central to every self-storage investment, but no metric causes more confusion. Here’s the lowdown on what they are and how they’re applied in the industry toward facility valuations and projections.

Self-storage investing is all about facility performance and value, with capitalization (cap) rates playing a pivotal but sometimes confusing role. To help you get a firm grasp of how and why they’re used in valuations and projections, let look at how they’re calculated and used within the industry.

What’s a Cap Rate?

Direct capitalization is a financial-analysis tool used to determine investment value or measure the performance of an income-producing property. Cap rates are used in this simple and quick method of valuation based on a facility’s net operating income (NOI). The process gives investors a snapshot value using 12 months of income and expenses.

In today’s aggressive self-storage market, it’s common to annualize the trailing three or six months of income and expenses. A cap rate attempts to quantify the risk profile of the future benefits. It’s essentially the ratio between purchase price and NOI. In other words, by converting income to value, a cap rate expresses the relationship of one year’s income and value.

How It’s Calculated

Capitalization valuation is calculated by using a simple algebraic formula that includes three components: NOI, property value and cap rate. When two of the variables are known, you can solve the equation to figure out the third: NOI / cap rate = value.

NOI is derived by deducting all operating expenses from the self-storage property’s annual income (monthly rents, truck rentals, moving and packing supplies, tenant insurance, late and admin fees, etc.). Depreciation, debt-service payments and income taxes aren’t included. The simple equations look like this:

Potential Rental Income - Vacancy and Credit Losses = Effective Rental Income

Effective Rental Income + Other Income = Gross Operating Income

Gross Operating Income - Operating Expenses = NOI

Industry Cap Rates

Cap rates measure the single, 12-month period of unleveraged (no financing) rate of return on a real estate investment and are used by self-storage buyers to determine if a property meets their criteria. The assumptions and judgments made in calculating future NOI (also referred to as underwriting) greatly affect the decision to invest and at what price.

Quick note: The cap rate applied to the trailing 12 months could be skewed if:

The facility hasn’t yet reached stabilization

It’s a value-add property with below-market rates

It includes acreage for expansion

Also, there are many management models used by self-storage owners and third-party management companies today, including automation platforms. Every one of them impacts NOI. The savvy investor underwrites based on their particular management style and revenue-management program.

In the end, the process of using cap rates involves judgment, knowledge of the real estate market and source-documents research. A figure is ultimately determined depending on each investor’s operational style, expectation of return and availability of funding.

Practical Application

Commercial real estate professionals and investors often seem to live and breathe by cap rates. Every real estate trade publication, market participant and third-party report regularly quotes cap rates and their trends. In reality, there’s much more that goes into underwriting a self-storage property than this “back of the napkin” approach.

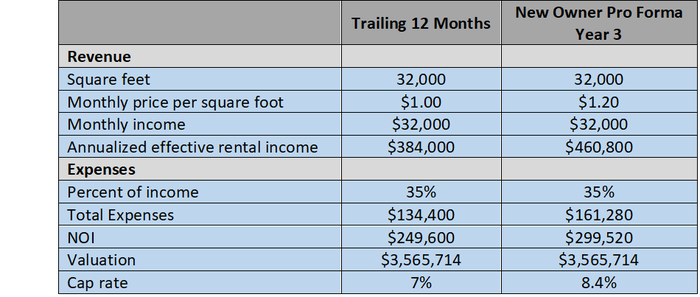

Though the primary advantage of using a cap rate is its simplicity of calculation, that simplicity also limits its reliability. After all, the cap rate doesn’t consider the impact of financing or income tax, nor does it look beyond a single, 12-month period. Still, even with a one-year income forecast, an investor can select a cap rate that reflects change in income and/or property value beyond the first year. The following is an example of how they could apply market rental rates during underwriting based on their management model for a value-add asset.

Behind the scenes, investors calculate yields and internal rates of return. They underwrite based on their management style, annual NOI increases, exit valuations, debt-leverage options and tax implications. You should also take into account immediate deferred-maintenance issues as well as ongoing capital-reserve requirements.

Key Takeaways

The key thing to remember is the lower the cap rate, the higher the facility valuation. The greater the spread between the cap rate and interest rate, the greater the cash flow will be. This past year’s historically low cap rates have created record-high self-storage valuations that have been amplified by low interest rates.

Generally, cap rates follow the same trends as the 10-year treasury. The impact of double-digit inflation and rising interest rates is already being felt in secondary and tertiary self-storage markets.

Jane H. Sauls and Luke Sauls are co-owners of Sauls Storage Group LLC, a Carrollton, Georgia-based brokerage and consulting firm specializing in self-storage and other commercial real estate. Jane’s career has been involved in construction and project management, site selection, feasibility studies, exit strategies, and building pro formas for self-storage owners of all sizes. Luke assists investors through acquisition, disposition and asset valuation. He aligns his goals and services to best cater to the needs of his clients. To reach them, call 770.841.4591; email [email protected] or [email protected].

About the Author(s)

You May Also Like