The Self-Storage Industrys Extraordinary Times: How Long Will They Last?

Nows a good time to buy, sell or refinance a self-storage property. The effects of the continuing low-interest-rate environment and increased investor confidence have been a boon for owners looking to sell or refinance as well as buyers on the market.

June 7, 2011

By Ben Vestal

Nows a good time to buy, sell or refinance a self-storage property. The effects of the continuing low-interest-rate environment and increased investor confidence have been a boon for owners looking to sell or refinance as well as buyers on the market.

During the relatively brief history of the self-storage business (35 to 40 years), public perception of the industry has changed dramatically. Wall Street has embraced self-storage, and life-insurance companies and conduit lenders have come back to the market, enamored once again with lending on properties with terms similar to core asset classes such as office, retail and industrial.

Along with the respect the self-storage industry has earned over the years has come an increase in competition. Facility owners are now realizing that sophisticated operations and economies of scale are imperative to business survival. This is more apparent than ever before as we see large operators winning business away from smaller ones, whether by pricing, advertising or property amenities. In general, the large operators are able to get a rent premium over small operators with similar properties in the same markets. This leads me to believe the industry has reached a crossroads, and operators need to make the necessary adjustments to compete as self-storage matures.

The effects of the continuing low-interest-rate environment have had a dramatic impact on self-storage investments over the last six to nine months. The most obvious and positive result is owners are able sell their properties at close to historically high prices (reflecting on 2006 and 2007) or refinance and keep a larger share of their hard-eared income by paying less to lenders. Lets not forget that just 12 to 18 months ago, the general consensus in the commercial real estate industry was that many owners would be facing maturity defaults, as property values had fallen as much as 40 percent and there were very few lenders willing to commit to new loans.

Were now seeing values rebound faster then anyone thought possible. Low-leverage refinancing deals are again able to achieve non-recourse loans with terms very similar to the peak of the market. Higher-leveraged deals also seem to be finding a home, albeit at higher interest rates and with strong personal guarantees. This is not to say ill-conceived projects or properties bought with unrealistic expectations during the boom of the mid-2000s are not still struggling. These projects will continue to struggle and slowly work their way through the system. As they say, time cures almost anything; this seems to be also true about the real estate business.

The other noticeable impact of low interest rates has been on the pricing of self-storage facilities in relation to their income. This is, of course, in recognition that new buyers will be able to obtain financing at lower rates and achieve higher returns. In essence, each dollar of income becomes worth more to a buyer. Using typical market rates (capitalization rates) for computing this increase in value, on average a project would have gone up about 15 percent over the last year or so, with no increase in net operating income, largely because of the compression in cap rates over the last six to nine months.

However, it is important to note that as the self-storage industry matures, the sophisticated capital and operators who are able to pay the highest prices are now drawing a line in the sand between institutional- and non-institutional-grade properties. This has led many small operators to wonder why they cant achieve the same low cap rates as other properties in the market. This bifurcation in value between large and small properties and large and small markets will continue, and many of the smaller operators will be faced with a difficult decision.

A Perfect Environment?

Maybe the most important indicator of where the market is headed is investor confidence. According to PricewaterhouseCoopers first-quarter 2011 real estate survey, its on the rise. The improvement in the national economy has translated into increased investor confidence and commercial real estate fundamentals in general.

The real question is whether this will continue and how long the recovery will last. The current low-interest-rate environment and investor confidence has created an almost perfect environment for anyone thinking about buying, selling or refinancing. I know that this sounds like a broker talking, but lets see if you agree:

Buying: Buyers today can purchase good properties and achieve cash-on-cash returns not seen in last few years because of low interest rates. They also have the strategic advantage of understanding how a property has performed during the worst downturn in the last 40 years.

Selling: Sellers can enjoy near historically high prices, which are also being fueled by the low interest rates and increased investor confidence, all while enjoying some of the lowest capital-gains taxes in history.

Refinancing: After the last few years, if an owner does not understand the importance of locking in a loan at a low interest rate for as long as possible, he needs more help than a new loan.

With these thoughts in mind, the next logical question is whether this improvement will continue and at what pace. Pursuant to the liquidity crisis of 2008 and the subsequent quantitative easing programs by the Federal Reserve, investors have become increasingly concerned about the prospect of inflation, particularly in light of the rapid rise in oil and global food prices. The question, of course, is when to jump into action.

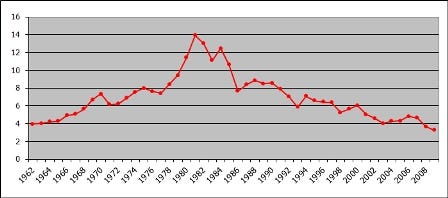

Since we have discovered the dramatic impact of interest rates, it might be helpful to review their history. The accompanying chart shows the 48-year history of U.S. 10-year Treasury bonds. Interest rates on these bonds, plus a spread, are most often used to set the pricing on self-storage loans. The spread has ranged in the last 20 years from 1.15 percent to 5 percent, so a graph of self-storage loans would be even more exaggerated in its swings. As a general rule, all spreads increase as interest rates increase and money tightens.

As you can see, interest rates can be very volatile, changing as much as 2 percent to 4 percent in just a few years. Following are a few observations. Give some thought to whether the risk of inaction outweighs the probability of improving your position through lower interest rates.

There have only been five years out of the last 49 when the 10-year Treasury bonds have been consistently below 4 percent: 1963, 2008, 2009, 2010 and now 2011.

In addition, rates over the last 49 years were 3.5 times as likely to be in the 6 percent to 8 percent range as where they are today and equally likely to be in the 12 percent to 14 percent range.

A 2 percent increase in the interest rate on a normal loan (6 percent, 25-year amortization) has the same impact on cash flow after debt service as raising your operating cost 23 percent.

These extraordinary times have created opportunity if you are considering buying, selling or refinancing. It all comes down to your objectives and the actions you must take to reach them. Now is a great time to make a move. If not now, when?

Ben Vestal is president of the Argus Self Storage Sales Network, a national network of real estate brokers who specialize in self-storage. Argus provides brokerage, consulting and marketing services to self-storage buyers and sellers. For more information, call 800.55.STORE; e-mail [email protected].

You May Also Like