Ready at a Moment’s Notice: How to Ensure Your Self-Storage Facility Is Always Prepared for Sale

If you’re a self-storage owner, regardless of your exit strategy, you should operate your facility as if you plan to sell it tomorrow. You never know when opportunity might knock or circumstances will force your hand, and you want to maximize return if a sale occurs. Read why this is important and some areas in which to focus energy to increase valuation.

As the economic climate continues to change, it’s more important than ever that self-storage owners operate their facilities as if they plan to sell them tomorrow—even if they don’t. It’s always good to have an exit strategy; but regardless of your plans, market conditions and property performance can always have an impact. Your goal should be to ensure that if and when it comes time to sell, you have the right mindset and strategy to maximize return.

Of course, it's always appropriate to think about your business goals and desired timelines. If you’re an independent self-storage owner, your exit plan may be based on retirement. If you’re part of a larger investment group, it may be based on a certain level of return. Either way, it’s wise to be ready to pivot if the right opportunity presents itself or circumstances force your hand. If that were to happen tomorrow, would you be ready?

Facility Valuation

For any self-storage seller, it’s a given that the highest possible sale price is desired. To determine facility value, many in the market today apply the following formula:

Net Operating Income / Capitalization Rate = Sale Price

The capitalization (cap) rate is largely determined by the market, current interest rates and buyer sentiment. You as the seller have little control over the cap rate; thus, the variable on which you should be hyper-focused is net operating income (NOI). The greater the NOI, the higher your facility value, and the bigger your sale price. Understanding that small actions today can make a big difference in tomorrow’s self-storage valuation is critical to implementing a strategy that’ll maximize your cash flow.

Facility valuation is vital every day, not just when you’re ready to sell. Putting pen to paper to track the following items each month will ensure you understand your self-storage operation in the context of current, local market conditions. You’ll be able to see whether you’re improving cash flow and valuation, and quickly identify red flags.

Dollar amount of actual rent roll

Number of occupied and vacant units

Dollar amount of delinquent accounts

Monthly debt-service payment

If you wind up negotiating finance terms over the next 24 months, you could face new challenges. In this case, you should also focus on:

Total loan balance

Today’s valuation

Percent of loan to value

Market conditions, technology and buyer sentiment rapidly change, so you must be ready to capitalize on non-controllable opportunities. Run several what-if scenarios. If you’re considering a sale within the next 36 months, the true question is: Will you be able to increase NOI enough to offset the impact of rising cap rates?

Maximize Income

The best way to maximize your monthly self-storage income, protect your NOI and improve cash flow is to focus on revenue management or, more specifically, rent increases. Every little bit helps. As street rates will likely become more competitive, the best way to combat rising costs is to execute small, incremental increases on existing tenants. To understand how successful this strategy can be, let’s look at a couple of scenarios.

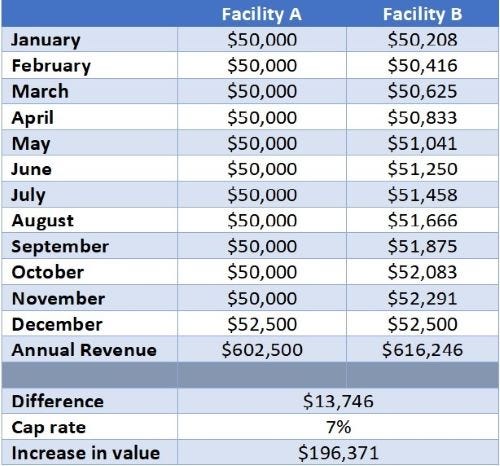

Facility A executes all of its rent increases at the end of the year, all at once, raising the rate on every tenant who’s been with the company for at least a year. Facility B looks at its tenant list every month and increases the rent by 5% on every customer who hasn’t had an increase in the last 12 months. Which process do you think is more manageable and maximizes cash flow? The second one, of course! Here’s why.

Let’s assume both facilities start the year with a $50,000 monthly rent roll. If the owner increases all tenants by 5% at year-end, it boosts income by $2,500 in month 12, yielding annual revenue of $602,500. However, if they increase rent by 5% for one twelfth of customers each month, it increases the total rent roll by $208 dollars per month. By the end of the year, they’ll have increased revenue by $16,246. That’s an NOI boost of $13,746. If we apply a conservative 7% cap rate, that’s a positive impact to valuation of $196,371!

Keep in mind, this is just one way to raise NOI and, therefore, facility value. The point is to focus on the parts of the equation over which you can exert the most control. This approach can empower you to react quickly to changing cap rates and buyer sentiment.

Getting Your House in Order

As demand cools and self-storage returns to being a seasonal product with reasonable rent growth, underwriting will shift accordingly. Investors will examine your books more closely, and financial institutions will require adequate history on property performance. The collective mindset will return to examining how properties are actually performing as opposed to what the new owner will be able to do with the facility under new management.

That said, now’s the time to tidy up your operation! Start by doing the following:

Kick out non-paying tenants (including friends and family), or start charging them rent.

Clean out personal units and downsize to a minimum need.

Ensure charity units have a set period of free rent and a signed lease in place.

All units should be rentable. Fix faulty latches, door springs and other issues.

Execute lien sales for units belonging to delinquent customers.

Remove non-related business expenses from your bookkeeping.

Deposit cash in the bank to ensure management reports align with bank statements.

Shop your vendors to ensure you’re getting the most value for your spending.

Refresh your website with current facility pictures. A strong online presence also includes the ability for customers to rent and pay online.

Compare street rates by price per square foot for each unit size and adjust accordingly.

Many self-storage owners believe the persistent myth that if you improve the property at the time of sale, it’ll increase its value. In reality, you’ll likely see a dollar-per-dollar return as opposed to getting dinged for deferred maintenance. It’s important to understand that the physical appearance and condition of the property, often referred to as curb appeal, is for customers, not the investor/buyer. Investors view your deferred maintenance as a value-add opportunity and want to pay a discounted price as a result.

The value occurs with continual upkeep. Customers attracted to your well-maintained self-storage facility will be willing to pay more at the time of rental and not push back on price increases during their stay. The more attractive the location, the better quality of customer your site will draw. This also helps deter crime and minimize delinquent accounts. Taking the time to improve the overall image of your property as a function of running the business helps ensure rental revenue increases that go straight to the bottom line.

The current economic climate of high inflation and rising interest rates demands self-storage owners’ attention. This is the year to be intentional and diligent in your daily actions. Know your numbers and work with a team that understands your return expectations. If you strategize on how to maximize your cash flow, your valuation will benefit! Have a plan, but be ready to pounce, pause or pivot.

Jane H. Sauls is a broker and co-owner of Sauls Storage Group LLC, a Carrollton, Georgia-based brokerage and consulting firm specializing in self-storage and other commercial real estate. Her career has included involvement in construction and project management, site selection, feasibility studies, exit strategies, and building pro formas for self-storage owners of all sizes. She’s a graduate of the University of West Georgia and holds a Certified Commercial Investment Member designation. To reach her, email [email protected].

About the Author(s)

You May Also Like