Similar but Different: Comparing Self-Storage Tenant Insurance and Protection Plans

Offering your self-storage customers a way to shield themselves against loss of or damage to their stored goods is beneficial for everyone involved. Thankfully, there are two products on the market for this purpose: tenant insurance and tenant-protection plans. The author makes a comparison and provides advice for choosing between them.

Offering your self-storage tenants loss coverage for their stored belongings has become an industry best practice. The two most common products used for this purpose are tenant insurance and tenant-protection plans, both of which provide value to the customer and business owner. Under these programs, renters can shield themselves against unexpected loss at a low monthly cost, and facility operators can collect additional revenue. Let’s examine the similarities and differences between these options to see which may better suit your operation.

Similarities

There are two primary similarities between tenant insurance and a tenant-protection plan. The first is customer experience. To the renter, the coverage and claims process between these two products doesn’t look for feel much different. In fact, they’re functionally identical. The tenant pays a monthly fee (premium for insurance or additional rent for a protection plan) in exchange for contents coverage. The claims experience will depend on your choice of adjuster and program administrator, not on which option you offer.

The second similarity is profit opportunity. In either case, operators can expect the product to generate 8% to 10% of their total revenue. However, this is highly dependent on finding the right partner who offers a favorable revenue share. I’ll explain more about that in a bit.

Differences

Now let’s look into the key distinctions between self-storage tenant insurance and protection plans.

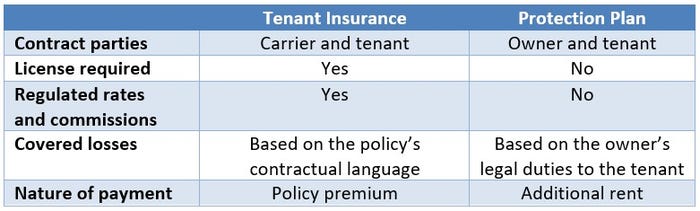

How risk is transferred. Under standard tenant-insurance programs, a master insurance policy is issued to the store owner. Upon program enrollment, a tenants receives an insurance certificate, which makes them am “insured.” The policy creates a direct contractual relationship between each enrolled customer and the insurer.

Tenant-protection plans aren’t insurance policies. Instead, the transfer of risk begins with the facility’s rental agreement. A self-storage lease typically contains an exculpatory clause that disclaims any liability the facility owner may incur due to loss of or damage to a tenant’s stored goods. A tenant-protection plan amends the agreement to waive that clause.

A reputable protection plan also involves a contractual liability insurance policy (CLIP). With this in place, the self-storage owner transfers any risk assumed under the protection plan to an insurance carrier.

Licensure. This is the most obvious difference between tenant insurance and a tenant-protection program. Many states allow self-storage owners to sell tenant insurance under a limited-lines license. In contrast, tenant-protection plans aren’t regulated insurance contracts. They’re rental-agreement riders, so no facility staff need to be licensed to sell it.

Rates and commissions. Insurance is regulated individually each state, and the laws can vary. When you sell tenant insurance, your ability to offer a sales commission to employees or change tenant rates is governed by local legislation. Tenant-protection plans don’t have the same regulatory oversight, which gives you more flexibility when it comes to setting rates and incentivizing sales staff.

Covered losses. Tenant-insurance policies are designed to cover purely fortuitous losses. The facility operator is only accountable to participating tenants for liabilities imposed under the law. On the other hand, a tenant-protection plan will also cover losses that arise from business negligence or fault, such as a preventable issue due to a lack of maintenance or security.

Nature of payment. For insurance, a tenant pays a regulated policy premium. To obtain a protection plan, they pay additional rent as stipulated in their lease agreement.

Choosing a Partner

When evaluating tenant-insurance and protection-plan programs, conduct your due diligence and select the one that best serves your business needs. Understanding the key differences between these products is a good first step, but you should also consider ease of implementation, potential revenue, and the professionalism and responsiveness of the tenant-claims experience. Answering the following questions will help you vet potential providers.

Who carries the risk? Know who’s responsible for carrying the risk and for what losses. Ask who the insurance carrier is behind the program as well as their rating. Aim for at least an “A” rating.

What’s covered? Ask what’s included. Does the program cover unit break-ins? How about theft of or damage to vehicles, including boats and RVs? Also, look for less-common coverages that protect from losses that arise from mold and mildew, rodents, and water damage.

What’s the revenue share? You should know exactly how much money your self-storage facility will make in connection with each policy or plan sold. Ask if the revenue share is fixed or variable based on submitted claims.

What’s the cost and effort to implement? Get a detailed plan for implementation including associated costs. This is especially pertinent when licensure is required. The right partner will provide you with a list of resources needed to make the program a success.

What does it cost your tenant? Know what the monthly cost is to renters and how much coverage they receive. Standard programs start around $12 per month, with coverage up to $2,000.

How are claims handled? You should be given a clear explanation of what will happen when something goes wrong. Ask how quickly a tenant can expect to be paid for an approved claim as well as whether the claims process can be easily completed online.

Is there claims transparency? A provider that gives you access to claims details, including status, cause and coverage amount, will enable you to better manage your facility and even identify pressing repair and maintenance needs.

What customer education is available? Tenant insurance and protection programs are only successful when your self-storage customers participate. A good provider will have strategies in place to help ensure broad adoption, which helps maximize your net operating income.

What reporting is available? You shouldn’t have to switch between property-management and accounting software to figure out how your coverage solution is affecting your operating performance. Look for a partner that understands the self-storage industry and offers robust, automated reporting across all your software systems. This will ease the burden on your accounting team and provide a clear view of your program’s impact.

What technology do they use? Find out how the provider leverages technology. Do they use the same tools as you? If so, this will complement their offering.

Providing your self-storage tenants with the option to purchase contents coverage is an effective way to manage risk while boosting revenue. Use what we’ve discussed as a starting point to determine whether tenant insurance or tenant protection is the right fit for your operation, and then arm yourself with smart questions to ask to find the right provider.

Nate Kinet is chief revenue officer at SafeLease, a tenant-protection provider that partners with self-storage operators nationwide. The company leverages technology and a partner-centric business model to create new revenue channels that maximize the value of commercial property assets. Kinet has overseen new partnerships, with more than 600 facilities resulting in more than 175,000 units enrolled in the SafeLease program. For more information, email [email protected].

About the Author(s)

You May Also Like