The State of the Self-Storage Capital Market: A New Way to Think About Industry Finance Options

The self-storage finance market is beginning to feel the pinch of today’s higher interest rates. What are the options for owners and investors? Get insight to the availability and cost of capital as well as alternative funding options to explore.

January 13, 2024

We’ve come a long way since the Federal Reserve started bumping the federal funds rate (FFR) in March 2022 in an effort to cool the economy and tame inflation. That rate has now risen to its highest level since January 2001. Though inflation has cooled, it hasn’t yet reached the 2% target level, and we continue to see mixed indicators that suggest the economy is resilient.

It’s still unclear whether the Fed has finished making rate hikes. Only time will tell if there’ll be an economic “soft landing” vs. a recession. But going into 2024, there are clear indications that we’re near the peak of the increases. If, in fact, a soft landing is achieved, elevated FFR may stay in place longer, perhaps the full year.

The dramatic speed and extent of recent interest-rate increases is likely the single greatest self-storage financing challenge since the Great Recession of 2007-09. The major difference between then and now is that slump brought lending to a complete halt, while today there’s still plenty of capital available—albeit at much higher rates than we’ve experienced in 10 to 15 years.

For the foreseeable future, interest rates are predicted to remain at or near current levels, and self-storage owners and investors need to manage their assets accordingly. Pricing and finance decisions are being impacted for everything from refinancing to acquisitions to new development. Regardless of its source, new capital is likely going to be priced 3% to 5% higher than just a couple of years ago.

What to Expect From Lenders

The high-interest-rate environment doesn’t change the fact that self-storage is still among the preferred commercial properties on which to lend, as it has a reputation as a stable and resilient asset class. However, the industry is quickly evolving, with increasing reliance on third-party management, sophisticated revenue-management systems, and more remote or hybrid operational models. Facility operators are experiencing significant increases in insurance, real estate taxes and payroll, which are eating into the bottom line. Some report that they’re no longer experiencing the traditional seasonality of the business given new consumer and economic activity. Occupancy levels nationwide have leveled off, with some markets seeing slight erosion. Street rents, though very localized, are starting to shift downward in some areas.

When seeking funds, owners need to consider the factors influencing their operating results and be prepared to address these changing industry dynamics. The rapid increase in interest rates has put tremendous pressure on the capital markets, particularly the banking system. While there haven’t been any closures since First Republic, Signature Bank and Silicon Valley Bank, everyone’s on edge, and lenders are weighing their risks. Many will be in a “wait and see” mode and likely change policy as the year progresses. This’ll be based primarily on the performance and returns of their existing assets and liabilities.

Higher rates also put pressure on existing loans, and the default rate on maturing loans is likely to increase. For example, lenders who may have particularly high exposure to the office sector are likely to have more credit exposure. The heightened risk awareness from capital providers could lead to an uneven playing field in which stronger borrowers and properties have access to capital, while weaker ones have fewer alternatives. Also, with an emphasis on deposits, in some cases, lenders may require an expanded depository account beyond the operating account.

The Impact on Leverage

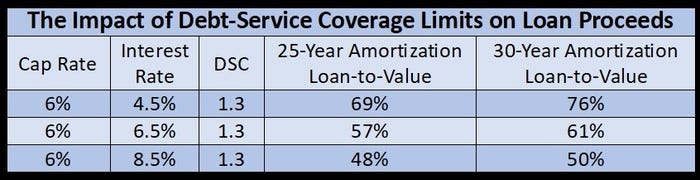

Another major impact of higher interest rates is lower leverage, as more cash flow is now needed to pay debt service. In other words, the amount you can borrow will be based on debt-service coverage (DSC) constraints. For self-storage owners who need financing soon, loans will be based on appraisals determined by increased capitalization (cap) and interest rates.

In the accompanying table, we see that loan proceeds decrease as interest rates rise. To obtain the same loan proceeds at 8.5% as at 4.5%, a property would need to have achieved year-over-year NOI growth of 13% for three years. Thankfully, however, most self-storage owners were able to increase their NOI at a record pace during the pandemic.

Self-storage transactions are inevitably impacted by the cost of capital. A cap rate is simply the anticipated return before debt. Until the rise in interest rates, cap rates were generally higher than mortgage rates, giving rise to an accretive return when additional debt was placed on an investment. In the current market, some assets are being traded at cap rates less than the financing rate. Thus, if financing is put in place, it’ll result in negative leverage, i.e., a lower investment return.

While sales volume is down from prior years, there’s ongoing discovery as to the price at which any given asset or portfolio will trade. According to Ben Vestal, president of real estate firm Argus Self Storage Advisors, there’s been a steady increase in cap rates in the range of 1% to 2% and sometimes higher in response to the rise in capital costs.

In this market, each transaction stands on its own, with buyers and sellers having unique motivations. Vestal also explains that a buyer will weigh their cost of capital along with the cap rate calculated based on historical performance as well as internal ongoing (year one to 10) operating projections to determine their pricing strategy. Though asset valuation will play a factor in the ability to borrow, the loan dollars will be curtailed by DSC as determined by the lender’s underwriting.

The Impact on Development

The ability to obtain self-storage construction financing has been further challenged by higher interest rates. When adding the interest carry to increased supply and labor costs, some projects simply don’t pencil out any longer. However, the lenders who continue to have the appetite and ability to make new commercial real estate loans typically welcome the opportunity to consider self-storage requests, including developments.

Just keep in mind that conventional lenders have become more discerning. They’re often reserving their funding capacity for existing customers, the most compelling projects, and the most experienced self-storage developers and operators.

Looking at Capital Differently

Access to self-storage capital needs to be looked at in new, creative ways that reflect the current market dynamics. Traditional methods to obtain debt and equity may not be the most beneficial right now. Alternative options include:

Seller financing. With current interest rates, leverage offered by traditional lenders is often maxing out at the 50% to 60% loan-to-value range. Seller financing may provide a viable, attractive solution for buyer and owner. The buyer may be able to get higher leverage and a better interest rate, while the seller may be able to defer capital-gains tax and achieve a higher sale price. The buyer may also have more flexibility to refinance down the road.

Equity raise. With debt options often in the 7% to 8% range, equity and debt may require similar rates. Some investment sponsors are acquiring assets using all cash with “friends and family money,” with the intent to secure debt later.

Loan assumption. One of the features of commercial mortgage-backed securities (CMBS) debt is it allows for loan assumptions. In the past, this would not often be the most attractive option; but with current rates being potentially 3% or higher than the existing debt, it may make economic sense for a buyer to consider this route.

Existing fixed-rate debt. Most self-storage owners locked into historically low rates a few years back and have some time before their loans mature or reset. The rise in rates and decline in property values are mainly relevant if you’re financing or selling now. Otherwise, you need to start planning for upcoming loan maturity. You should be calculating what loan amount your property will likely support based on forward-looking interest-rate assumptions.

There may be individual situations in which refinance proceeds won’t be sufficient to pay off existing debt. In these cases, the best course of action may be to modify or extend the current loan, infusing capital and refinancing at a lower amount, or selling the property.

The New Norm

Placing new self-storage debt will require a whole new way of thinking about the terms that are important to you and your investors. In previous years, the strategy for many was to maximize leverage and fixed rates for as long as possible. Today, investors might look for solutions that involve leveraging less at higher rates and obtaining loan terms that provide flexibility should rates decrease in the coming years.

While we may be near the end of rising FFR, the cost of capital will have a lasting impact on commercial real estate for years to come. None of us can predict the future, so you should be thinking about how higher interest rates may influence your investments and how to best position yourself.

Looking at the forward curve, both the five- and 10-year Treasury yields are predicted to move slightly but stay above 4%. If those predictions are correct, fixed-rate debt won’t be going back down to the historic low but is likely to be more in line with rates we’re experiencing today, maybe slightly less. As a self-storage investor or owner, it’s time to review the performance of your assets and how to best manage your debt with higher interest rates being the new norm.

Neal Gussis is the executive director of capital markets at Strat Property Management Inc., a self-storage investment, management and consulting company. Throughout his 30-year career,

Neal has arranged more than $5 billion in financing for industry owners nationwide. He can be reached 847.922.3750 or [email protected].

About the Author(s)

You May Also Like