Rising Rates and New Supply Signal Cautionary Shifts in Self-Storage Financing

Rising interest rates and increased supply are creating rental-pricing pressure in some self-storage submarkets. Learn how these factors will have a direct impact on your ability to borrow from lenders.

November 11, 2018

Self-storage financing is beginning to feel a little different these days. There’s no denying the industry has enjoyed an outstanding run for several years, fueled by strong occupancies, year-over-year revenue increases, strong valuations and investor demand. There’s also been plentiful availability of debt at low interest rates. The problem is some of these factors have started to plateau.

Specifically, interest rates are now on the rise, and an increased supply of facilities has created rental-pricing pressure in some submarkets. This will have a direct impact on your ability to borrow money.

Upward Pressure

In a way, we’ve been lulled into a comfort zone during the past few years thanks to low interest rates and only incremental movement by the Federal Reserve when it’s made policy changes. Further, the economy has been humming along with the lowest unemployment levels in nearly 50 years; the Dow Jones has bumped against new highs; and the federal government has provided fuel to extend the recovery from the 2008 financial crisis.

But don’t get too comfortable. These factors are really just precursors for interest rates returning to more normalized (i.e., historically higher) levels. As of early October, the Fed had raised the Federal Funds Target Rate (FFTR) three times in 2018, with an additional rate hike likely before year-end.

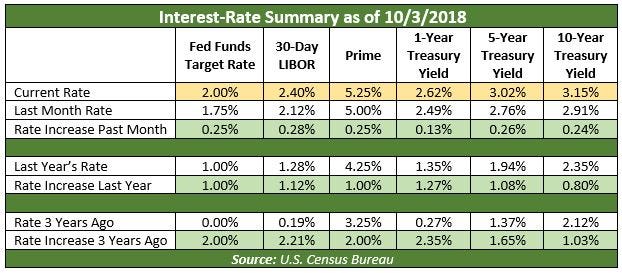

Lenders base loan rates on a spread over various indices. The accompanying table highlights rate increases for several commonly used indices, including a recent 30-day period, year over year, and the past three years.

Historically, the 30-day LIBOR and prime rate are highly correlated to FFTR movement. So, as the Fed continues with incremental bumps, you’ll see these rates move accordingly.

Short- and long-term Treasury yields are based on many factors and aren’t linear relative to FFTR adjustments. Looking at the table you’ll notice shorter-duration bond rates increase at a faster clip than longer-term bond options. Thus, we’re inching closer to a flattening yield curve in which short-term loans will pay interest rates equal to, or even above, longer-term loans.

Good News, Bad News

It’s always better to start with the good news. While rising indices mean loan rates are on the rise, a positive takeaway is spreads have remained neutral or slightly decreased. This has softened the increase in resulting mortgage interest rates.

Further, stretching back to the fourth quarter of 2015, the Fed target rate, 30-day LIBOR and prime rate, which are typically used for variable-rate loans, have increased approximately 2 percent. At the same time, the longer-term 10-year Treasury yield, which is tied to fixed-rate financing, has inched up only about 1 percent.

When factoring in spreads over the indices, many variable-rate loans tied to the prime rate and LIBOR that had lower overall interest rates compared to five- or 10-year fixed-rate loans are now actually higher and will continue to climb as the Fed further increases the target rate. Nearly all construction loans are variable-rate and will be affected by these changes.

Now for the bad news. Higher interest rates cause debt-service payments to rise and put additional stress on debt-service coverage (DSC). This means the availability of maximum loan dollars decreases because minimum DSC is needed to meet the lender’s requirement covenants.

The minimum DSC constraint—usually between 1.2 percent and 1.3 percent (calculated by net operating income divided by debt payment)—may result in loan proceeds at a lower loan-to-value (LTV) ratio. This is particularly applicable in markets where properties are valued on relatively low capitalization (cap) rates. For example, buyers seeking 75 percent LTV leverage should know that greater equity may be required for their next purchase.

Development and Construction Financing

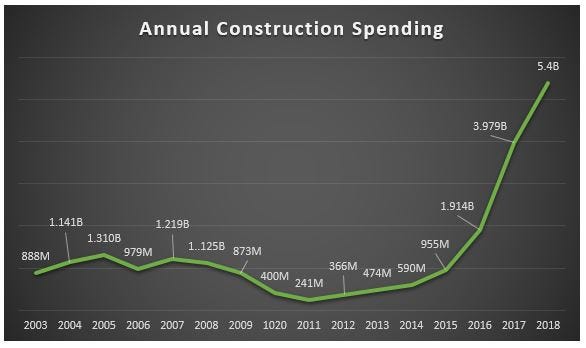

When capital was tight and only a few lenders offered financing, virtually no new storage facilities were constructed between 2009 and 2012. Once capital became readily available from debt markets and investors, new developments started tracking at record levels in 2016. A record $9.39 billion was invested in self-storage from January 2016 through August 2018, according to U.S. Census data. During the same period, 1,858 facilities opened nationwide, Union Realtime figures show.

This graph, using data from the U.S. Census Bureau, illustrates construction put in place, not seasonally adjusted. Note: The last four months of 2018 are estimated at the same monthly level of spending as August 2018.

Despite these recent development and construction surges, self-storage remains a micro-market industry, and it’s impossible to categorically state that an entire Metropolitan Statistical Area (MSA) or market is overbuilt.

Most new storage developments, particularly larger, multi-story properties, have occurred in the top 50 MSAs. Given pent-up consumer demand, many of these projects leased up more quickly than projected. However, as we get further into the development cycle, lease-up is now taking longer than expected, requiring many operators to offer discounted introductory rates to attract renters.

In many cases, the lead time for finding a site, planning, entitlement and permitting is lengthy. And as we experience a market shift, project assumptions from 24 months ago are likely quite different today in relation to construction and financing costs, lease-up rates, and stabilization projections. Some projects simply may not pencil out any longer to attain a developer’s anticipated return on investment.

How Lenders View New Projects

There are still many lenders who will provide construction financing for new projects. Key for them is the sponsor’s strength and experience, as well as the development’s feasibility and underlying economics. No two lenders will underwrite a deal in exactly the same way, but a common element to transactions being written is if they believe there’ll be take-out or permanent financing at stabilization.

Accordingly, lenders will take assumed stabilized NOI and conduct a stress test with criteria that typically include a 25-year amortization, a 6.5 percent (plus or minus) interest rate, and a DSC ratio of 1.3 or better. Given today’s market conditions, don’t assume they’ll consider pro forma rent increases. On the contrary, they may apply a discount to rental rates.

Financing Existing Facilities

An existing property’s historic performance is the primary determinant in the loan amount and terms. Lenders also consider new competitors, including those in the supply pipeline. If new competition has put downward pressure on street rates and monthly revenue, lenders will likely be less aggressive with loan proceeds.

It’s also imperative to work with a lender or mortgage broker who understands the unique dynamics and economics of self-storage. You don’t want to go down the road with a lender who’ll have the underwriter apply current, lower street rents to existing customers, as facility operators often implement price increases to existing tenants, even as street rents decrease.

Planning Ahead

It’s always good to stay ahead of the curve. With interest rates inching upward and new-supply market pressures affecting so many locales, here are a few financing tips to consider:

Look to switch from variable- to fixed-rate financing.

Refinance sooner rather than later. Lock in a lower interest rate and maximize loan proceeds.

For maximum loan proceeds, seek lenders that offer longer amortization or interest-only periods.

Seek loan quotes on acquisitions early in the process so you’re not surprised by equity requirements to close.

Re-evaluate development economics for projects in the pipeline; err on the side of being conservative.

The best news is there are plenty of capital providers aggressively seeking to lend to self-storage owners and developers. Just be mindful that they can’t control interest rates or new supply.

With more than 25 years of experience as a national self-storage mortgage broker and advisor, Neal Gussis is a principal at mortgage-banking firm CCM Commercial Mortgage. He specializes in securing debt and equity for self-storage owners nationwide. He can be reached at 224.938.9419; e-mail [email protected]; visit www.ccmfinancing.com.

About the Author(s)

You May Also Like