CPACE Financing: How It Works and Why It’s a Great Fit for Eco-Friendly Self-Storage Projects

A viable finance option of which self-storage owners and investors may not be aware is the Commercial Property Assessed Clean Energy (CPACE) program, which can be used to fund environmentally friendly property improvements. Learn how it works and why it’s a particularly good fit for some real estate developers.

If you’re having trouble securing debt and equity for your pipeline of self-storage development projects, you aren’t alone. These days, banks don’t know if they’re lending or not, to whom, or at what leverage. Meanwhile, equity investors are pulling their money from speculative real estate projects and jamming it into risk-free 5% money markets. But rest assured, there are still options available!

One to consider is the Commercial Property Assessed Clean Energy (CPACE) program, born out of the Connecticut Green Bank, which can be used to finance energy- and water-related improvements connected to commercial real estate projects. It can be used to finance up to 30% of the stabilized value of a property and is applicable for all asset classes, including self-storage.

Typical applications for CPACE include ground-up construction, repositions/value-adds and energy-related capital projects. At fixed rates and with maturities of up to 30 years, these loans are repaid through an incremental property-tax assessment, which can remain with the asset upon sale.

The first CPACE projects were funded in 2009, and as of May, more than $5.2 billion had been financed in 32 states and the District of Columbia. In the map below, the blue states are those that have an active program.

Why Consider CPACE?

CPACE makes it possible for owners of self-storage facilities and other commercial properties to obtain low-cost, long-term financing for projects that promote energy efficiency, water conservation and renewable energy. The program starts with a state-level government policy that classifies clean-energy upgrades, such as a new sewer, water line or road, as a public benefit. These upgrades are repaid as a benefit assessment on the property-tax bill over a term that matches the useful life of improvements and/or new construction infrastructure (typically around 20 to 30 years). The assessment transfers on the sale of the property.

While facilitating sustainability efforts, the program reduces a property owner’s annual costs and typically provides better-than-market financing for qualified projects. In addition to offering fixed rates, CPACE is long-term, non-recourse and non-dilutive. Readily available, it’s been used to assist with:

Project financing: To fund an energy-related project, such as an HVAC replacement or elevator upgrade, without the need to refinance a first mortgage or pay out of cash

Paydowns: To provide principal curtailment to a senior lender for a recently completed project (last 36 months) to free up the balance sheet and give them the ability to finance your next project

Payouts: To use leverage-created value from a recently completed project (past 36 months) to pull out equity to pay off investors without having to refinance a senior loan

Plugs: To fill a gap in the capital stack for a ground-up construction or conversion

Participation: To remove participation risk from a ground-up or conversion project by allowing a one-bank close

In addition to benefitting the owner, CPACE supports environmental impact in the surrounding community as well as local-government sustainability initiatives. Resulting projects tend to:

Increase their energy efficiency and reduce monthly utility bills

Help protect businesses from natural disasters

Create local jobs and drive economic growth locally

Contribute to shared environmental, social and governance goals that are increasingly important to policymakers and investors

The Self-Storage Fit

With strong cash flow at stabilization, self-storage facilities are uniquely positioned to take advantage of CPACE financing. To get a better idea for how this can be used to your advantage, let’s take a quick look at three actual case studies from the last 18 months. Two were ground-up developments, and the third was a conversion of an old printing facility.

In each case, expensive mezzanine financing and/or dilutive, preferred equity was replaced with CPACE priced 350 to 400 basis points above the 10-year treasury fixed rate at closing for the duration of the loan (20 to 25 years). This financing dramatically reduced the weighted average cost of capital and allowed the sponsors to reduce their equity raise and retain more ownership.

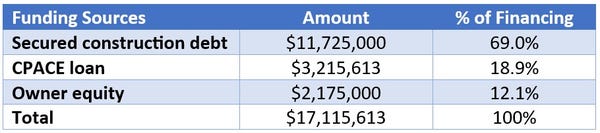

Case study 1: Ground-Up Construction in Connecticut

Items funded by CPACE: Above-grade walls, fenestration, roof, interior and exterior lighting, HVAC, elevators and domestic hot water

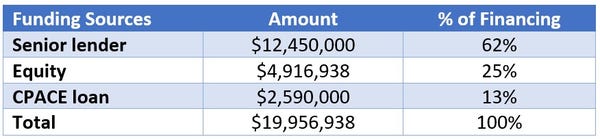

Case Study 2: Ground-Up Construction in New York

Items funded by CPACE: Interior and exterior LED lighting, enhanced wall insulation, high-efficiency HVAC system, low U-factor windows, additonal roof insulation

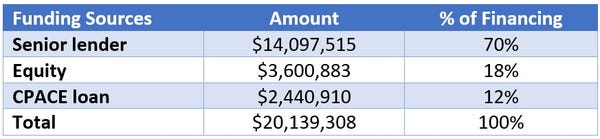

Case Study 3: Conversion Project in Maryland

Items funded by CPACE: Fenestration, roof, elevator, solar array

Keys to Successful Execution

Though CPACE financing can be an attractive way to help fund a worthwhile self-storage project, here are three basic hurdles you need to clear to unlock that capital:

Financial underwriting: Confirm that the project features adequate cash flow at stabilization to support the senior loan and CPACE.

Technical review: Confirm that the financed energy- and water-related improvements will meet the program requirements.

Lender consent: Educate your senior lender in an effort to obtain their consent and ensure a successful closing.

To increase your chances of securing funds, consider hiring an experienced team to help you work through crucial pieces of the process. CPACE offers a great financing opportunity, so it makes sense to have someone knowledgeable in the program and how it aligns with self-storage projects working on your behalf.

Jason Schwartzberg is co-founder and president of MD Energy Advisors, a Baltimore-based business that works as a partner to provide solutions that meet the energy-management and efficiency goals of commercial clients, utilities and government. He was an early pioneer in working to secure energy-cost reductions for property owners. To reach him, email [email protected].

About the Author(s)

You May Also Like