With the self-storage acquisitions market alive and well, it brings to light the continued bifurcation in the market between institutional-type investors and non-institutional ones. This new crop of investors has changed the way self-storage operators obtain financing for acquisitions.

April 17, 2012

While I strongly believe the performance of self-storage as an investment will be quite positive in the long run, theres reason to believe the game has changed thanks to large investment groups entering the business.

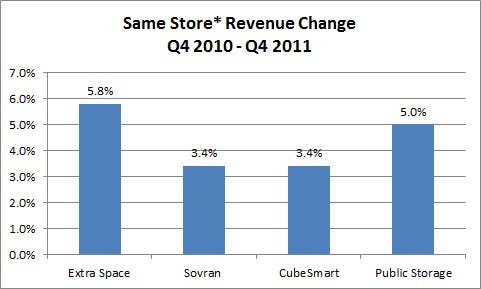

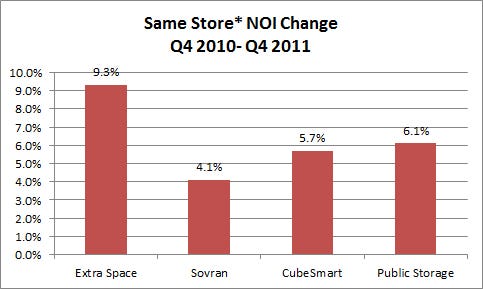

In reviewing the fourth-quarter 2011 same-store operating numbers for the four major real estate investment trusts (REITs), revenue for each was up between 3.4 percent and 5.8 percent from the fourth quarter of 2010. More important, all four showed substantial gains in net operating income (NOI), ranging from 4.1 percent to 9.3 percent. In the new and improved self-storage real estate market, 90 percent or more of value is still in the NOI. Cash is still king, and the ability to attract and capture tenants in cyberspace is now the industry norm.

Note: Same-store numbers are based on 253 Extra Space stores, 244 Sovran Stores, 331 CubeSmart stores and 1,931 Public Storage stores. (Source: Grubb & Ellis Fourth Quarter 2011 REIT Report)

With the acquisitions market alive and well, it brings to light the continued bifurcation in the market between institutional-type investors and non-institutional ones. Its important to note institutional doesnt just refer the four major REITs; its any group in todays market that has access to relatively inexpensive capital/equity. This has allowed these types of investors to buy properties at an aggressive pace over the last 12 months.

It has also created two different pricing structures, since the aggressive buyers are not willing to buy smaller properties (less than 50,000 square feet), and are just now starting to consider second-tier marketsalbeit at a substantial discount to what theyre paying in major markets. According to the National Association of Real Estate Investment Trusts (NAREIT), self-storage REITs returned 35.2 percent last year, the second consecutive year the sector has led the pack. The recent published success of the storage industry, along with the return of confidence among real estate investors in general, has resulted in mainstream real estate investors racing to it. This new crop of investors, including pension funds, private-equity funds, university endowments, ultra-high net-worth individuals and non-self-storage public companies, has changed the game on several levels. Outlined below are some of the basic reasons.

Access to Capital

All the investment groups mentioned above have tremendous access to capital, whether from banks, life-insurance companies, strategic partnerships, public markets (issuing new common stock) or simply from their own balance sheets. The availability of capital to these types of groups is considerable, and the cost of this capital is substantially lower than an average retail customer.

For example, if youre an ultra-high net-worth individual, family office or pension fund and have significant balances in your money market accountswhich are paying less than 1 percent annually todayit might make sense to not use debt at all. Therefore, the cost of capital is simply the value these groups put on their liquidity.

Its also apparent public companies with the ability to issue common stock in the public markets, such as the REITs, have access to capital at approximately the cost of their dividend yield. As of March, the four major self-storage REITs all had dividend yields between 2.7 percent and 3.5 percent.

Its worth mentioning that most of the groups noted above use traditional financing at some point, but their ability to pick and choose the timing of their financing, accumulate large amounts of assets in investment pools, and negotiate better terms with their lenders gives them a significant advantage when acquiring and operating properties.

Why does this all matter? If youre an independent operator and borrow $1 million from a bank or other financial institution with 5.5 percent interest, a 25-year amortization and a term of five years, your annual debt service would be $73,680. If youre a public company that pays an average dividend yield of 3 percent and issues $1 million of common stock, your annual cost of the $1 million is $30,000.

As you can see, this frees up approximately $48,000 in cash flow to the public company the independent operator would not have. In addition, the common stock doesnt mature after five years, meaning the public company has no refinancing risk.

A Shift in Marketing

Tremendous strides in the technology used in the storage industry have been made over the last five years. Gone are the days of the Yellow Pages and good signage. Were now seeing search-engine optimization, pay-per-click advertising, social media, blogs, YouTube videos, social-media reviews and mobile apps dominate the marketing budgets of most storage companies. Its clear a paradigm shift in marketing has occurred, and its working.

The adoption of these new marketing techniques has been accelerated by the large institutional investors. Because of the depth of their resources, theyre adapting proven Internet-marketing techniques from other real estate product types and applying them to self-storage with great success. All these strategies have proven to attract customers from a greater distance, make facilities more user friendly and, most important, increase the value of the product.

While storage remains a positive long-term investment, the game has clearly changed. Due to the large investment groups and high rates of return, there have been dramatic increases in situations where conflicts of interest occur between a service provider and an owner. With approximately 40,000-plus independent storage owners in the market today, its critical for facility owners to make sure theyre seeking advice from consultants, brokers and third-party management companies that have their best interests in mind. Its important to have them working for you and not themselves!

Ben Vestal is president of the Argus Self Storage Sales Network, a national network of real estate brokers who specialize in self-storage. Argus provides brokerage, consulting and marketing services to self storage buyers and sellers and operates SelfStorage.com, a marketing medium and information resource for facility owners. For more information, call 800.55.STORE; e-mail [email protected].

About the Author(s)

You May Also Like