The self-storage industry is enjoying an extraordinary development cycle, but the rapid pace of construction could lead to overbuilt markets. Business experts examine the rate of growth, areas that could be in trouble, and how developers and owners can expand responsibly.

Just five years ago, self-storage development was at a standstill. Few projects were greenlit as the country recovered from The Great Recession. Then something happened. Banks began to lend again. Developers dusted off aging blueprints, and soon a new era of construction began. While it started as a trickle, it soon became a boom.

As the industry enters its third year of heavy development, it’s standing at a crossroads. The road signs are clear. One leads to overbuilt markets in which new projects and established operators suffer a crash in occupancy and rental rates. The other is a controlled growth led by smart owners and developers who seek markets where demand still outweighs supply.

Great Growth

It’s an excellent time to be in the storage business. Scores of new investors are entering the industry while existing owners are expanding their sites and portfolios. In addition, many operators are experiencing higher occupancy and steadily increasing their rates.

“Nationwide, self-storage continues to do well as an industry. We expect to see revenue growth in the 2 percent to 4 percent range nationwide over the next few years,” says Ben Vestal, president of the Argus Self Storage Sales Network, a national group of real estate brokers. “The demand for the product remains strong and growing in many markets.”

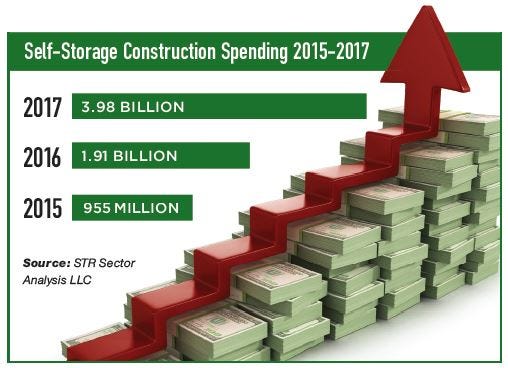

When an industry is humming along, everyone takes notice—and often wants a piece of the pie. Positive vibes combined with low building over several years has led to an upsurge. “The self-storage industry is in the midst of an unprecedented development cycle,” says Anne Hawkins, executive vice president of STR Sector Analysis LLC, a data and analytics specialist that tracks self-storage development in 56 of the nation’s largest Metropolitan Statistical Areas (MSAs). Not only did construction spending jump 108 percent in 2017, it experienced a whopping 317 percent growth over 2015 levels, STR reports.

This year’s early figures show continued momentum. According to Hawkins, numbers from the U.S. Census Bureau for April showed self-storage construction spending of $475 million, a 7 percent increase over March and a 21 percent increase over February. Year-over-year, it increased by 80.6 percent, from $263 million in April 2017.

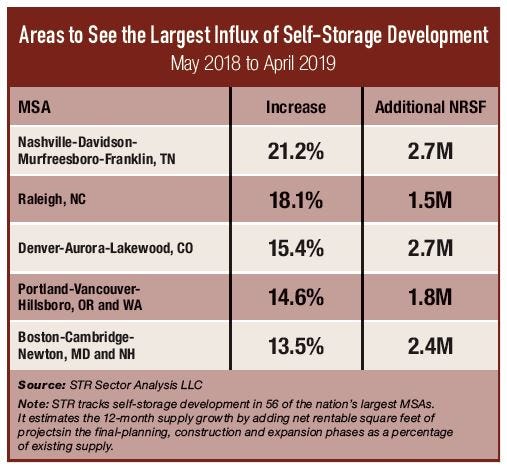

In May, STR projected there’ll be 68.5 million net rentable square feet of new self-storage supply to come online by April 2019, an increase of 7.4 percent. This is based on projects already under construction, existing sites that are expanding and those in the final planning phase.

Market Watch

After tracking development over the past four years, Argus sees that most new projects are in the top 50 MSAs, with very few in secondary markets. “Taking it one step further, most of the new or proposed developments have been clustered in their respective markets. This is has led to many new developers to the industry and seasoned industry professionals feeling that the overall market is getting overbuilt,” Vestal says. “However, the concerns of overbuilding on a national scale are meaningfully overstated, and only certain submarkets and clusters within the top 50 MSAs are going to feel the real pain of overbuilding.”

There are major markets that are already feeling the squeeze. They include cities like Denver, Miami and Nashville, Tenn. However, beyond the sprawling metropolises, it can be difficult to pinpoint regions that are already oversaturated or nearing it.

“Because self-storage is a submarket and, often times, a micro-market business, it’s challenging to talk about overbuilding at a national or even MSA level. That said, it is becoming increasingly difficult to identify successful development sites in most of the top MSAs,” says Jonathan Perry, executive vice president and chief investment officer for Jernigan Capital Inc., a merchant bank and advisory firm serving the self-storage industry.

Some developers have taken notice of this shift when seeking land for new builds. SurePoint Self Storage, which operates in Kansas and Texas, has always developed in areas with high barriers to entry. However, it’s becoming more difficult to find these locations, says Robert Loeb, a company partner. “We like to build where we feel unmet demand is double what we are building, and we want to build on the best site,” he says.

Texas cities such as Austin and Dallas as well as pockets of Houston and San Antonio are flirting with oversupply, Loeb says. “But any market can get overbuilt. If we put too much supply in a market, occupancy and price will suffer. This is double whammy-down,” he says.

Life Storage Inc., a self-storage real estate investment trust (REIT) that operates 700 facilities, including 161 in Texas, has felt some impact on its properties in the state, notably in the cities Loeb mentions. Other markets the company is watching include Atlanta, Miami and Raleigh, N.C. “But these are strong and growing markets that will absorb the supply and will be fine in the long run,” says Diane Piegza, vice president of corporate communication and community affairs.

Even so, the company is more focused on buying than building. “We believe there are excellent opportunities to improve the operations of existing facilities; therefore, our concentration remains on acquisitions,” Piegza says.

Life Storage recently joined forces with research firm Union Realtime LLC in a partnership that will inform development choices for the REIT and other industry developers. “What began as a means for us to monitor rates and specials at our competitors turned into a more collaborative relationship to share data on new development,” Piegza says. “Life Storage focuses on development within a five-mile radius of our existing locations; Union Realtime will bring additional intel on markets where we don’t operate but are considering entering. Likewise, we can provide validation of their results in the markets in which we do business.”

Conscious Choices

Another company making a concerted effort to avoid overbuilding is Bitterroot Holdings, a privately held enterprise that owns and operates 10 Keylock Storage facilities in Northwest. Bitterroot has turned its focus to second-tier markets. “We choose our markets based upon continually healthy growth and where we feel we can outperform the other facilities in those markets,” says co-founder AJ Osborne.

As such, the company recently walked away from several potential development sites. “We are extremely concerned and have passed up several opportunities and blacklisted a lot of markets due to overbuilding,” Osborne says. “We had several projects we were entertaining in Boise, Idaho, that we ran away from. We are in that market, and it’s not just being overbuilt; the operators don’t seem to be doing their numbers or are OK [with] having very poor performing assets.”

Bee Safe Storage and Wine Cellar announced last fall that it would scale back on its development in the Southeast due to oversupply in some markets. The company operates seven facilities in the Carolinas, and planned to invest about $250 million in more than 30 projects in the region. Owner Roy Carroll told “News & Record” he was beginning to see market saturation. “We are long-term players and will deploy our capital when the market fundamentals dictate; but we are pumping the brakes on areas in the Southeast where the development pipeline just doesn’t make sense,” he says.

Moratoriums

Worried about an abundance of self-storage facilities in their region, some government officials are enacting moratoriums to stop or slow development. Although many of the freezes have been temporary while officials evaluate zoning laws and plans, some have passed permanent bans.

This spring, the Arvada, Colo., City Council unanimously approved a 180-day moratorium to temporarily block self-storage applications. Officials in Denver also approved a ban on self-storage in some areas. Earlier this year, New York City Council members overwhelmingly voted in favor of banning self-storage development within industrial business zones without a special-use permit. The city also created a two-year application process, which includes a uniform land-use review procedure. Other cities to establish development barriers include Margate, Fla., Poulsbo, Wash., and Woodland, Calif.

Self-storage professionals have mixed views on this legislation. While some agree new regulations could keep overzealous or uninformed developers from building where there’s no unmet demand, others believe it isn’t the government’s place to make these decisions.

“I’m not opposed to this. Good, healthy markets are better for the builders and the consumers,” Osborne says.

Conversely, Benjamin Burkhart, a self-storage developer and owner of BKB Properties, doesn’t believe the government, at any level, should choose an industry’s winners and losers. “Governments are using ‘saturation’ as an excuse and, often, it’s driven by interested parties trying to ward off competition,” he says. “In some areas where there are moratoriums, additional storage is absolutely needed, and the moratorium makes no sense.”

Other Contributors

There other factors that could curb future development, in all sectors of real estate, including a nationwide construction-labor shortage combined with a rise in materials costs. A decline in construction during the recession pushed many skilled workers into other industries. While some have returned and new people have entered the workforce, many markets are still struggling to find skilled craftsman.

“The labor shortage and longer lead times have, in a way, helped throttle back the speed of development. If construction could keep up with the investors, the self-storage market might have imploded by now,” says Steve Hajewski, marketing manager for Trachte Building Systems, which designs, manufactures and erects pre-engineered and customized steel self-storage systems. “The extended building cycle does have the advantage of restricting supply and keeping rental rates up, while at the same time giving future developers a better opportunity to identify other sites coming online and possibly changing plans to avoid overbuilding.”

Another influence that could hinder projects is the recent tariffs on imported steel and aluminum, which could lead to higher costs and even shortage. “I don’t think any major manufacturer is using imported steel, but that reduced supply and speculation drove up prices overnight,” Hajewski says.

Thankfully, financing continues to flow in the storage industry for new projects backed by strong borrowers. Still, some lenders are beginning to add more borrower requirements, particularly in response to overbuilding buzz.

“Banks have continued to lend to developers during this cycle, but such loans have had tighter loan-to-cost limits, more personal recourse and more covenants than may have been the case in past cycles,” Perry says. “Because of that, fewer development deals make it to the finish line, and developers have lower house limits, thus suppressing to some degree how many development projects they can pursue at any given time.”

According to Yardi Matrix, a data-services platform from Yardi Systems Inc., self-storage construction loan originations have dropped significantly over the last 12 months, Perry says. “That supports our belief that the cycle is getting into its late stages, and development projects are becoming harder to justify economically.”

A final factor contributing to the threat of overbuilding is the sheer size of today’s storage facilities. Many new projects are larger than in years past, with some comprising 125,000 to 150,000 square feet or more, which means more available units in a single market.

Why are sites getting so much bigger? Building a larger site is often preferred by developers who’ve had to jump through several hoops to get approval from city officials. Another bonus is construction costs for items such as elevators, gates and office build-out can be spread over a larger pool of units. However, to fill all this space, operators will often use specials, which can have a negative impact.

“If you build a massive site all at once, you minimize the amount of time spent dealing with the design and permitting process. On paper, this looks good,” Hajewski says. “The problem with developing these properties is that they can take longer to reach their break-even occupancy.”

What Is Saturated, Really?

So, when is a market saturated? “Simply stated, it’s when the market can’t absorb all the existing storage supply to an acceptable level of occupancy,” Burkhart says. When this happens, operators can expect a softening in occupancy and rental rates as more facilities fight for the same pool of customers.

“The impact to the existing operator isn’t as substantial because a certain portion of their tenants are long-term,” Burkhart says. “For the new operator, it may mean undercutting market rents to drive lease-up and navigating a longer lease-up period. This typically means larger cash-flow shortfalls during the riskiest part of investment: from zero percent to 60 percent or 70 percent occupancy when all the bills and all the debt is covered.”

The effects can be viewed differently depending on one’s perspective. “We are finding today that many new self-storage owners feel a market is overbuilt when the submarket’s occupancies are below 88 percent,” Vestal says. “This is largely due to the fact that they have underwritten the market to a 90 percent or better occupancy.”

As a builder, Loeb is realistic about lease-up for SurePoint’s new locations, considering them stabilized at 85 percent. “We do not allow ourselves the luxury of thinking 90-plus percent is the norm,” he says.

Established and larger operators, including the REITs, have been able to drive occupancy but might be realizing lower rental rates. When a quality property can’t achieve or maintain a profitable occupancy without significant discounting, it’s a clear sign there’s too much supply, Hajewski says. “When you see a three-year-old property at 60 percent occupancy, that market is overbuilt.”

While some will rely on national benchmarks to determine how much storage an area can absorb, these numbers aren’t accurate for every market. “What reflects the status of supply and demand is rental rates and occupancy. We can infer some things about future demand based on projected growth; but there are markets with 4 square feet per person that are overbuilt, and some with 20 square feet per person that need more,” Burkhart says. “Data and analysis from specific micro-markets matters most when making investment decisions, not national averages.”

The fact is there’s no magic number to indicate saturation. “A holistic approach to evaluating markets and submarkets must be taken to fully understand the local dynamics of the self-storage industry,” Hawkins says. “To get the clearest picture, we need to evaluate our submarkets, with an emphasis on the unique demographics that characterize each.”

Mitigating the Impact

As the self-storage industry continues to grow, it’s imperative to build responsibly. Constructing too much too fast or selecting a poor site in a busy market could lead to weak lease-up for new projects and depress rental rates for all.

“There are markets that are certainly heading in the direction of overbuilding or are in fact overbuilt,” says Gary Cardamone, CEO and owner of Nuvo Development LLC, which offers architecture, development and engineering services to the storage industry. “Our strong suggestion would be for developers to have a professional market study completed prior to deciding to develop.”

Facility developers and owners should establish their own set of building principles. “Set them, challenge them and stick with them,” says Cardamone. If something in the market changes, such as an increase in material costs, a long entitlement period or even a moratorium, you’ll have a plan.

Also, remember that not all storage is equal. Consider what new products and services you can bring to a community. “We look at the market in terms of product. If we feel there are certain products, like indoor storage, that haven’t been served, we will build,” Osborne says. “But we do not build for the sake of building, and do not believe in the ‘If you build it they will come’ approach.”

Finally, pay attention to the facts. “Accurate data is the critical factor in gaining a deeper understanding of the local nature of the self-storage industry,” Hawkins says. “It’s essential to analyze supply, pipeline, performance and demographic data together to get a better understanding of the local dynamics of the self-storage industry and to make the appropriate business decisions. From data, we can appreciate how certain areas are riper for self-storage development, while others may be oversaturated.”

While the quality and quantity of industry data has improved drastically in recent years, it’s still behind that of other real estate sectors. “This improvement in industry information has, in a lot of ways, spurred the recent self-storage development boom and created a lot of interest from new, more mainstream developers and investors,” Vestal says. However, because collection is difficult and fragmented, there are gaps, which can lead to misinformation and guesswork.

“This lack of accuracy and industry nuances have led many very sophisticated developers and investors who are accustomed to receiving very accurate market information to believe that a submarket is under or oversupplied,” Vestal says. “It’ll take time and, most likely, two to three real estate cycles; but the industry is taking great strides to provide the best possible information to the overall market.”

In the end, potential overbuilding is just part of the growing pains a real estate sector must endure as it matures. “The improvement of market-specific industry information is the only way to control growth and avoid overbuilding,” Vestal says, “but there will undoubtedly be some bumps along the road.”

About the Author(s)

You May Also Like