While self-storage is still a relatively new concept across most of the Asia-Pacific region, research shows it has firmly arrived in Greater China. Here’s a look at how the success in Hong Kong has spurred development on the Mainland and in Taiwan.

December 13, 2015

By Samson Lam and Markus Scherer

While self-storage is still a relatively new concept across most of the Asia-Pacific region, our most recent research shows it has firmly arrived in Greater China. The remarkable success of the self-storage industry in Hong Kong has set the stage for the development of the industry on the Mainland and in Taiwan. Let’s take a look at how the industry is developing, region by region.

Hong Kong

In Hong Kong, where the most expensive property converges with the highest population density in the world, extra storage is almost a luxury. With demand constantly outstripping supply, self-storage has quickly blossomed into a well-developed industry with great market traction.

Ipsos Business Consulting, which offers fact-based market analysis to businesses worldwide, estimates the total gross floor area of self-storage at 4.25 million square feet. Based on the assumption of an average floor-space utilization of 50 percent to 70 percent, Hong Kong has a net floor area of 2.125 to 2.975 million square feet. This is an increase of 4.4 percent since 2013.

At the end of 2014, Hong Kong boasted an estimated 93 self-storage companies, with a network of approximately 524 locations. In comparison to 2013, this is a year-on-year increase of 5.2 percent and a whopping 17.7 percent, respectively. The top six players account for just under 60 percent of the total gross floor area, with SC Storage estimated to be the largest player in the market, closely followed by Store Friendly.

While all these numbers might seem impressive, an estimated core penetration rate of 23 percent suggests there’s still room for the industry to grow. The core rate is the percentage of people between the ages 18 and 45 who are using or have used self-storage services within the past year. With some locations able to demand an average rental rate of more than HKD 60 per square foot ($7.75 USD), this shows just how attractive this market can be for operators.

Mainland China

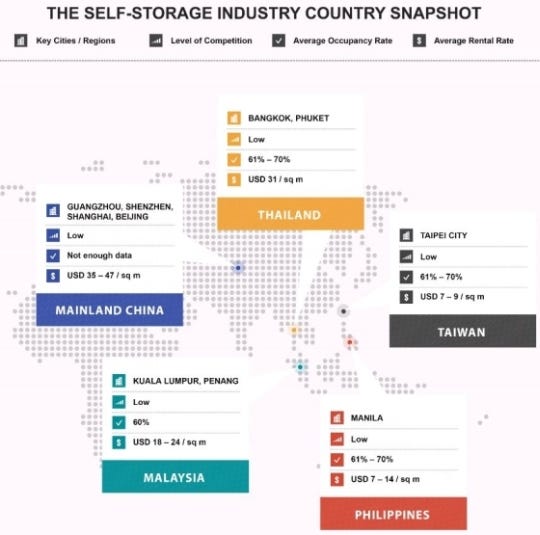

In comparison to Hong Kong where the industry is already well-established, our research shows self-storage is primed to take off in Mainland China. The success of the first industry event organized by the Self Storage Association Asia (SSAA), which took place in May in Tokyo, underlines our findings. Luigi La Tona, executive director of the SSAA, describes the opportunity in Mainland China to be “one of the most exciting opportunities that will impact the industry over the next decade.”

Due to China’s large size and vast regional differences, the self-storage market is extremely fragmented, making it more difficult for players, as there’s no one-size-fits-all formula for success. Although some large operators have established a foothold in the market and have aggressive plans for expansion, much education is needed to convince Chinese consumers of the benefits of self-storage and how it can fit into their lives as a practical, convenient lifestyle option.

Already today there are 28 operators in China, with 91 locations spread across seven cities including Beijing, Chengdu, Guangzhou, Hangzhou, Shanghai, Shenzhen and Wuhan. Of these, Chengdu has the lowest yearly average per capita income of CNY 70,000 ($10,990 USD). Taking this as a benchmark, we’ve identified a number of other cities with higher averages where we expect to see new storage facilities coming online in the near future.

Moving forward, low consumer awareness will be the biggest obstacle for industry growth in China, as many consumers aren’t aware of the service. However, facility operators are optimistic that growth over the next three to five years can top 20 percent.

Taiwan

Taiwan has all of the strong industry drivers typical of more mature self-storage markets like Hong Kong, such as high property prices and scarcity of space, making it an attractive destination for brands interested in tapping its potential. The development of Taiwan’s self-storage industry is similar to that of Hong Kong from 2002 to 2006, when consumer awareness of the service wasn’t very high.

Though still in its early stages, the industry is already characterized by robust competition, with at least 18 brands operating 75 locations. Together, the top three players operate 45 facilities, with the rest being managed by smaller players and new market entrants.

Just under 90 percent of all locations can be found in the capital of Taipei. While we still expect the number of facilities to grow in this region, there are many cities across Taiwan where we expect to see even higher growth rates moving forward. In 2014, the average self-storage rental rates were between NT$220 to NT$280 per square meter ($6.70 to $8.55 USD), and the average occupancy was estimated between 61 and 70 percent.

Similar to the Mainland, operators in Taiwan are positive about the development prospects of the self-storage industry in the coming three to five years. They expect to see growth rates of 20 percent or potentially higher.

We see the future of the self-storage industry in Greater China to be positive. It’ll be interesting to track the industry and exciting to share in its development.

Samson Lam is a consultant at Ipsos Business Consulting in Hong Kong. He oversees all research activities covering self-storage across the Asia-Pacific region. He can be reached at [email protected].

Markus Scherer leads the consulting unit for Ipsos Business Consulting. In cooperation with the Self Storage Association Asia, he has been actively following the development of the self-storage industry across the Asia-Pacific region. He can be reached at [email protected].

Ipsos Business Consulting is the strategic business-consulting unit of Ipsos Group. The core penetration is based on a survey carried out by Ipsos Business Consulting in February 2015 in cooperation with the Self Storage Association Asia. Published in The Self Storage Association Asia Annual Survey 2015, it’s available for download. For more information, visit www.ipsosconsulting.com.

You May Also Like