One of the most serious issues facing self-storage investors today is the potential equity gap that can be created upon the maturity of their existing debt. But there are options to bridge this gap.

September 20, 2010

One of the most serious issues facing commercial real estate investors today is the potential equity gap that can be created upon the maturity of their existing debt. Its no secret that cash flow has been challenged during the last several years as a result of the economic recession. The effect of reduced cash flow from operation, combined with increased cap rates and lower leverage available from lenders, can dramatically impact available loan proceeds and result in the need for an equity infusion into the property upon refinance.

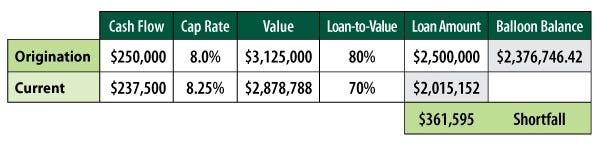

Consider the following self-storage property refinancing examples, which more clearly illustrate this point. A storage facility generating $250,000 in net operating income (NOI) five years ago would likely have qualified at that time for debt of around $2.5 million in loan proceeds (based on a cap rate of 8 percent and available market leverage of 80 percent).

Fast forward five years. Assuming only a modest decline of 5 percent in NOI, combined with a 25-basis point increase in cap rates and new available leverage of 70 percent loan-to-value (LTV) today, the borrower would realize a proceeds shortfall of roughly $360,000, which will be needed to refinance the transaction. Although generic and based on the assumptions used, this is a very realistic scenario many self-storage owners face given todays market conditions.

The simple fact is many owners dont have $360,000 tucked away for a rainy day. Although a significant problem, an owner faced with this predicament isnt at a total loss. There are options available to try to bridge this equity gap. To better understand those options, lets examine the components of the traditional capital stack in a typical real estate transaction.

The Capital Stack

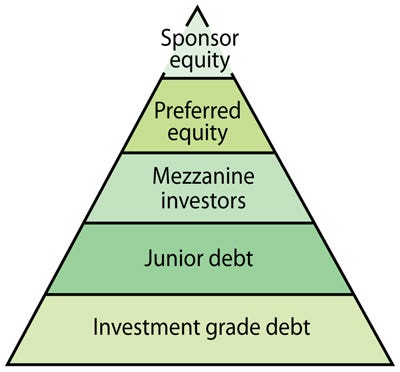

In the most simplistic form, any transaction has two primary components: debt and equity. The capital stack, therefore, refers to the totality of capital invested in the project, including equity, debt and any hybrid dequity products that sit in between.

Think of the capital stack as a pyramid containing the most risk at the top and the least risk at the bottom. Higher positions in the stack typically require higher returns for capital because of the greater associated risk. Lenders and equity stakeholders are very sensitive to their position in the stack and price their products accordingly.

Typically, the stack has the following arrangement:

Keep in mind that as value and other factors change over time, so too can a relative position in the capital stack. For example, as debt is reduced, the amount of equity increases, and vice versa. Given that sponsor equity (at the top of the pyramid) is essentially the owners cash position in the asset, it can be generally quantified as the propertys current value minus all priority positions lower in the stack. In a declining market, as property value drops, owner equity erodes. And if value declines faster than the debt can be retired, owner equity can quickly wear down.

Subordinate Debt Options

Subordinate debt refers to any additional financing junior in priority to the first mortgage. It is a powerful financial tool for self-storage owners. It can provide additional dollars and higher leverage to help bridge an equity gap created when first-mortgage underwriting standards tighten in response to perceived heightened market risk, when property values have declined, or both. More conservative origination underwriting will limit first-mortgage loan proceeds, but access to subordinate debt provides access to additional capital.

To recap, the order of priorities in the capital stack flows from the pyramids base or lowest risk position (typically the first mortgage), up through any subordinate debt position (in priority), and finally to the sponsors equity in the property. Assuming theres adequate cash flow to support debt service, subordinate debt can allow a borrower with limited equity to refinance an asset without being forced to take on additional equity partners and potentially sacrifice ownership in a property. The two most common types of subordinate debt are junior mortgages (often called B-Notes) and mezzanine financing.

Junior Mortgages

A junior mortgage is a secondary debt position secured by the mortgage property as collateral, but which is junior in priority to the first mortgage or senior note. In a two-note loan structure, the mortgage debt includes a senior first-mortgage note (A-Note) and a subordinate portion junior note (B-Note).

Although the two notes will likely have different loan terms, the payment priority is clear, with the A-Note having distinct priority over the B-Note. Both are secured by the mortgaged property collateral, often under a single loan agreement. In this structure, the subordinate nature of the debt is established through a lender inter-creditor agreement between the A- and B-Note holders.

Mezzanine Debt

Mezzanine debt is an alternative type of subordinate debt in which the loan collateral is secured against an ownership position in the borrowing entity rather than the mortgaged propertyessentially a pledge of the ownership interests in the property rather than the property itself. Mezzanine debt can be particularly useful because it will generally provide a structure that allows a borrower to obtain secondary-debt financing without violating the terms of an existing mortgage loan agreement that does not allow for secondary debt against the property collateral itself.

Considerations for Subordinate Debt

Subordinate-debt lenders are typically willing to assume more risk than first-mortgage lenders and receive higher interest rates for doing so. Subordinate-debt rates can range anywhere from 8 percent to 18 percent, with the loans typically paid each month along with the first mortgage. Subordinate-debt payments are often more flexible and can be structured to match the assets cash flow.

For example, they might be structured as an interest-only payment with a balloon, or amortized over time via routine interest and principal payments to reduce the debt. In the current market, subordinate-debt lenders will take a position between the first mortgage65 percent to 70 percentup to 85 percent of value.

Managing Event Risk and Equity Erosion

The magnitude of equity erosion often dictates the available solutions. As long as the debt doesnt expire and assuming theres cash flow in place to service it, the equity erosion may only be a temporary situation that effectively creates a short-term paper loss with little consequence for the storage owner.

In other cases, equity erosion may be so severe that the current sponsors equity is wiped out. In this situation, it may be necessary to reach even higher in the capital stack to achieve a solution, effectively forcing the property owner to give up equity ownership or controlling interest in the asset. If a transaction is too far under water, or if there is just too much perceived risk in the transaction, a complete debt restructure (potentially with a new equity infusion) may often be the only option.

In many cases, however, equity erosion is not that severe. If equity erosion is contained, and as long as the owner has cash flow available to service the debt, subordinate-debt options can present a very straightforward and palatable solution for filling the equity gap.

Shawn Hill is a principal at Chicago-based The BSC Group, where he provides mortgage brokerage, financial consulting, and loan-workout solutions to self-storage real estate owners nationwide. To reach him, call 713.517.8504; e-mail [email protected] , visit www.thebscgroup.com .

About the Author(s)

You May Also Like