More self-storage operators are beginning to add tenant insurance or tenant-protection programs to their business as they recognize the revenue-generating value of these offerings. See how you can make money through goods-protection services.

January 28, 2017

For many years, the focus on ancillary income for self-storage businesses has been on retail product such as boxes and locks or even truck rental. In 2013, fewer than 40 percent of operators offered any kind of tenant-insurance or property-protection program. But that’s beginning to change as they recognize the revenue-generating value of these offerings.

Making It Mandatory

You can offer goods-protection coverage to customers as an option, but a growing trend is to make participation in a program mandatory as part of the lease signing. With this bundling concept, the protection for stored goods is included in the rent as a tenant amenity. Every unit will have a certain level of coverage as part of the rental agreement, and the facility manager doesn’t have to sell the program as an add-on.

When properly written into the rental agreement, a lease-compliant program stipulates the renter must provide proof of insurance coverage to comply. If he doesn’t provide proof, he’s automatically enrolled in the facility operator’s program of choice for the minimum coverage available to satisfy the requirements of the lease.

Tenant insurance or property protection fills a need when a customer has no other option for covering his goods in storage, for example, if he lacks homeowners’ or renters’ insurance or has a high deductible on these coverages. With a lease-compliant program, every tenant is protected in the case of an unfortunate event. The transition to this type of program started in the industry as a trickle; but now the faucet is wide open for astute operators focused on providing value to their customers while increasing their bottom line.

Some industry operators that use a mandatory-style program include real estate investment trusts (REITs) Extra Space Storage Inc. and Public Storage Inc. These companies have generated $72 million and $84 million respectively in revenue through tenant insurance. They’re experiencing move-in participation rates of more than 90 percent and overall participation rates of 65 percent to 75 percent. As publicly traded entities whose focus is on investor value, these REITs are keenly aware that every dollar of net income produced by tenant insurance leads directly to increased shareholder value.

Making Money

The primary objectives of instituting a robust and active tenant-insurance or property-protection program are to generate revenue and help customers safeguard their goods. Along with these come the risk-management benefits that help you minimize your exposure to lawsuits from customer claims for things like “operator negligence,” water damage and burglary.

The income generated by a properly run program can range from $14,000 to $30,000 annually for a 500-unit self-storage facility. As a percentage of the cost charged to the tenant, revenue retained by the business can range from 25 percent to 90 percent depending on program type, services performed by the provider and the deductible. The lease-compliant program will have a move-in participation rate of 55 percent to 80 percent. Optional programs that allow the tenant to accept or decline coverage have participation rates of 5 percent to 30 percent.

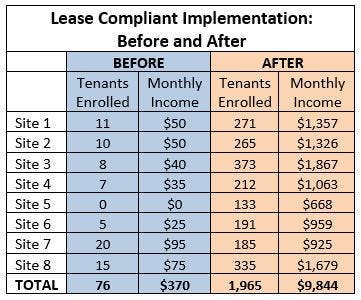

The accompanying table shows how a storage operator with eight locations achieved considerable revenue enhancement after switching from an optional to a lease-compliant program. Participation rates jumped from less than 5 percent to more than 68 percent, increasing monthly revenue from less than $400 to nearly $10,000.

As operators strive to produce greater revenue, lease-compliant programs are gaining favor with those who are willing to trade large gains in income for the possible loss of a few tenants over increased rental costs. As they discover the profit far offsets any tenant attrition, the word spreads and the programs become more popular. They key benefit is that when an unfortunate event occurs, hassles are considerably reduced when your tenants are all protected and properly indemnified by the tenant-insurance or property-protection provider.

When deciding on a program and provider, choose the one that yields the best value for you and your customers; then outline a plan with your staff to successfully implement the plan. This requires ongoing employee monitoring to ensure benchmark participation numbers are being reached and the program is being correctly presented to tenants.

Matt Schaller is president of Arizona-based Tenant Property Protection, which partners with self-storage operators nationwide to provide protection of tenant goods while maximizing facility revenue. Matt has more than 28 years of experience in the self-storage and insurance industries and has worked with companies that provide tenant insurance and property-protection plans. He’s licensed as a Certified Insurance Counselor and a Certified Risk Manager. For more information, call 877.575.7774; visit www.tenantpropertyprotection.com.

About the Author(s)

You May Also Like