Although we have macroeconomic risks, the capital markets have returned to health, partially as a result of the stability in the commercial mortgage-backed securities (CMBS) market during 2012. For self-storage investors and owners, all signs point to another strong year of healthy lending.

January 12, 2013

What a difference a couple of years can make. In December 2010, the capital markets were reeling in the post-recession environment. Financial headlines were dominated by phrases like "credit crisis," "auto-industry bailouts," "bankruptcies," "foreclosures," "credit card defaults" and "sovereign debt."

Fast forward to present day. Although we have macroeconomic risks (e.g., the fiscal cliff), the capital markets have returned to health, partially as a result of the stability in the commercial mortgage-backed securities (CMBS) market during 2012. All signs point to a strong 2013.

CMBS

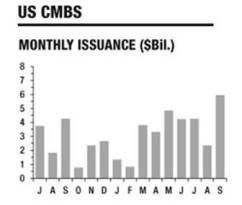

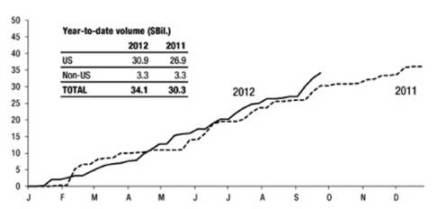

After inching back to life in 2010 and an up-and-down 2011, the CMBS market appears to be in full recovery. Based on the volume of CMBS issuance over the trailing 13-month period (ending September 2012, volume has clearly been steady since March 2012. Total estimated CMBS origination for 2012 was $47 billion, up from roughly $35 billion in 2011, and is estimated to be $50 billion to $75 billion in 2013.

The market continues to expand as competition for deals increases. With more than 20 originators competing, we have seen loan-to value (LTV) increase, debt yields drop, minimum loan size decrease, and the list of eligible metropolitan statistical areas (MSAs) increaseall positive news for self-storage owners, as more operators are eligible for CMBS financing.

CMBS lenders are aggressively seeking quality self-storage deals with spreads at 200 to 250 over the 10-year swap rate for lower leverage deals (less than 65 percent), and 230 to 280 over full leveraged deals (70 percent to 75 percent). Current 10-year swap rates are at 1.8 percent (as of Dec. 31, 2012), so borrowers are securing 10-year, fixed-rate, non-recourse loans at interest rates in the 3.8 percent to 4.75 percent range.

Here are some things you can expect when securing a CMBS loan:

Up to 75 percent LTV

Up to 30-year amortization

Debt yields as low as 9.5 percent

Non-recourse

Insurance and tax reserves

Defeasance or yield maintenance prepayment

CMBS lenders continue to include more self-storage facilities. In 2011, most active CMBS programs had restrictions that did not favor self-storage economics. Many lenders enforced loan minimums ($5 million and up), which limited storage potential to portfolios of assets or single assets in larger markets controlled by institutional quality sponsors. Today, many lenders are considering smaller loans (less than $5 million) in secondary markets, and at least three lenders have a stated loan program that will go below $2 million.

Insurance Companies

Liquidity in the CMBS market has provided an outlet for transactions on insurance company and regional/local bank balance sheets, so these lenders have the need to make new loans. Insurance companies, which are balance-sheet lenders, focus on large transactions with institutional sponsorship. They cherry-pick deals. The old adage is if you qualify for an insurance-company execution, no other lender can compete.

Insurance companies originated an estimated $60 billion in 2012, with a similar volume expected in 2013. Insurance companies have consistently provided capital for commercial real estate owners for over half a century. Through the last recession the insurance companies were one of the few active lenders. Theyll continue to be active in 2013 for the few self-storage transactions that fit their criteria.

Characteristics of insurance-company loans in today's market include:

Lower leverage (60 percent or less)

Institutional quality assets and markets

Larger loans ($5 million and up), with a few lenders willing to look at loans less than $5 million

Loans over $10 million considered "the sweet spot"

25- to 30-year amortizations

Fixed-rate loans up to 25 years (fully amortizing options available)

Rates similar to CMBS (10-year money around 4 percent)

Non-recourse (loans less than $5 million might have some recourse)

Flexible prepayment options (yield maintenance or step-down)

Greater flexibility than CMBS after closing for expansion or other significant changes

Significant net worth, liquidity and sponsorship required

Small Business Administration (SBA)

SBA loans provided significant liquidity in 2012 to the self-storage finance market, especially for smaller transactions in secondary markets. Storage became an eligible property type for SBA lending in August 2009, and the products have evolved. It was difficult to find a lender willing to exceed 75 percent leverage at the onset of the program for a self-storage asset, even though the stated limits were 85 percent and 90 percent for the 7a and 504 programs. Today, we see leverage between 80 percent and 90 percent.

An SBA loan is a great fit for a storage owner who needs higher leverage, has a smaller loan balance and may not be in a top market. The 7a program is available for acquisition and refinance. As of September 2012, the 504 program is not available for refinance. In early 2013, Congress may consider allowing refinancing through the 504 program.

SBA programs offer the highest advance rates available among major loan programs, but these loans are not meant for all owners. As the name indicates, they focus on active business owners and operators, not passive investors. The liquidity the SBA programs have brought to the self-storage market has filled a clear need and has increased the industrys stability, especially in secondary markets.

Banks and Credit Unions

Borrowers have more options today than they have the last four years, so banks and credit unions wanting to replace maturing balance sheet loans have had to open their doors to new borrowers. But not all banks are healthy; some are still in distress. Its important to know the financial condition of a prospective lender because the banks health may be a determining factor in its lending decision, even more so than the merits of the proposed project.

Banks continue to primarily focus on repeat customers in their geographic footprints, preferring short to mid-term loans, and either floating or fixed rates for three, five or seven years. Most banks offer 20- to 25-year amortizations, shorter than CMBS or insurance companies. Interest rates range between 175 base points to 400 base points over London Interbank Offered Rate (LIBOR) for floating-rate loans and 3 percent to 5.5 percent for fixed-rate loans.

Local and regional banks are the prominent construction lenders. Construction lending came to a halt four years ago, but we expect the re-emergence of the construction loan in 2013. A signal is a handful of construction loans made in 2012 as lenders looked to get money out the door and the improving economy justified some new development. As competition increases for mature loans, we anticipate lenders to consider making more construction loans. The selection process will be stringent, as only the most seasoned, well-capitalized developers will obtain financing.

Its a Great Time to Borrow!

Interest rates are at an all-time low. The 10-year treasury is hovering around 1.7 percent. Capitalization rates are low and continue to compress as new equity enters the self-storage market. With credit, there are higher LTVs, lower interest rates, more competition, healthier banks and looser credit standards. At the property level, you have improved operations, higher values and lower debt levels. The result is more deals than weve seen for years.

We dont know how long these conditions will last, but we know the window is open now. Take advantage of it if you can. This should be a great year to borrow.

Devin Huber is a principal at The BSC Group, which offers financial and loan advisory, mortgage-brokerage and loan-workout solutions to commercial real estate property owners and investors, with a special emphasis on the self-storage market. Prior to helping found The BSC Group, Huber was a senior vice president at Beacon Realty Capital and a key member of the firms Self Storage Group. To reach him, call 800.605.7880; e-mail [email protected]; visit www.thebscgroup.com .

About the Author(s)

You May Also Like