Preparing for and completing a closing are the most detailed and frustrating parts of the self-storage real estate sales process. The best way to make this tedious task easier and more efficient is to start early and work with a qualified team of experts.

November 23, 2010

Preparing for and completing a closing are the most detailed and frustrating parts of the self-storage real estate sales process. The best way to make this tedious task easier and more efficient is to start early and work with a qualified team of experts.

The preparation for a closing should begin before you list your property for sale. Deal points dont usually become problems at the closing. Many are recognized earlier, but simply postponed or ignored. Any issues that might arise at the closing should be addressed long before the parties get to the table. If youre able to identify them early, youll be able to come up with complete and well-planned solutions you can share with prospective buyers. This will increase the probability of a closing and also allow you to sleep better during the transaction.

The Team

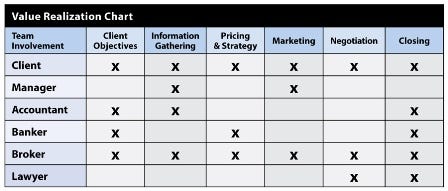

Get your closing team together even before you list the property and ask them to help with the entire selling process, not just the closing. People who should be on your team include your facility manager, accountant, banker, broker and lawyer. Youll also want to use an escrow agent. When you first think about selling, assemble this group and identify all the functions necessary to get the property sold. The accompanying value realization process chart outlines a general plan of attack and helps determine who needs to be involved in each step of the process.

Once you have your team in place, assign priorities, responsibilities and appropriate deadlines for each of the detailed functions. Monitor your schedule and plan for issues that will arise every two weeks throughout the selling process.

Theres a massive amount of information, especially financial, required to persuade a buyer, convince the buyers lender and complete the due-diligence process. Your manager and accountant are going to be very busy, so get them started early. Attorneys should be invited to the party early as well; not only will they prepare the documents for the contract and closing, but they can give you some good ideas and balance during the negotiations.

Accountant

Make sure you meet with your accountant prior to listing the property for sale. Its important to understand the tax implications of selling your facility, especially if you have 1031-exchanged into that property. Its easy to lose track of your basis in the investment, and that will have a major impact on your tax situation when you sell it.

The IRS changes the tax laws on a yearly basis, so its imperative to have a clear understanding of you situation and any time frames that must be met. Its every investors objective to put as much money as possible in his bank account and as little as possible in Uncle Sams.

Banker

Bankers today seem to be the most unpredictable part of the real estate team. This is largely due to the FDIC regulators who have been looking over their shoulders for the last couple of years. Its important to discuss your sale plans with your banker, as he may be less flexible on a prepayment penalty than he was three years ago when he made the loan.

He may also bring to light other issues that may have slipped your mind, such as the assumable nature of your loan or the banks willingness to allow a potential buyer to assume your loan, even if this is not stated in your loan documents. With the commercial-lending environment slowly starting to thaw, the terms of your existing loan may be attractive to a potential buyer, not to mention the possible cost savings on third-party reports in which a buyer may benefit.

Broker

The brokers primary duty during the closing process is to make suggestions as to how to solve last-minute problems, such as handling delinquent tenants and dealing with prepaid rent. The broker will also help coordinate the flow of information. Certain documents will need to be signed by both parties and information will need to be passed back and forth. This is when an experienced self-storage broker can really help smooth the transaction. His experience will allow him to get the paperwork going early, and his ability to explain the need for each document will put both parties at ease.

Make sure your broker reviews the closing statements. Hes been involved in the negotiations of the transaction and will have a good understating of deal-specific issues, such as who pays certain closing costs, loan-assumption fees and if the buyer is to receive a credit at closing for any deferred maintenance negotiated during the due-diligence process.

Lawyer

A note on attorneys: Many are quite willing to help you, but they believe a small real estate transaction is simple and they can handle it even if real estate is not their specialty. I encourage you to use an experienced real estate attorney. During negotiations, hell understand the subtle motivations of all the parties, such as the buyers, lenders and public agencies, because they work with them every day.

A real estate attorney will also have creative solutions to problems, not only because hes probably seen them before, but they have in-depth knowledge of the law and mechanics of transactions. This isnt a place to be cheap or let your friend do it.

Escrow Agent

This escrow agent knows the closing business well. Most of the time, he really streamlines and organizes the actual process. However, though most escrow agents are the greatest people on earth, they are human and, therefore, make mistakes or have bad days. For these reasons, have your team review everything they do and be sure you understand all thats happening at the closing. Remember, its your money theyre moving around.

The Closing

Before you go to a closing, make sure all issues are resolved. Going to the table with open issues generally means the seller will have two choicesto forego closing or cave to buyer demands. Also, be sure you know what every piece of paper means to you. If all the planning and preparation has been done right, all that remains is to have a very good lunch and move on to your next deal!

Ben Vestal is president of the Argus Self Storage Sales Network, a national network of real estate brokers who specialize in self-storage. Argus provides brokerage, consulting and marketing services to self-storage buyers and sellers and operates SelfStorage.com, a marketing medium and information resource for facility owners. For more information, call 800.55.STORE; e-mail [email protected].

About the Author(s)

You May Also Like