Self-storage operators are generating more facility revenue with tenant-insurance programs than ever before. However, some insurance programs may not be what they seem. Heres what you need to know before you sign on with a tenant-insurance provider.

August 27, 2013

By Harry Sleighel

Today, more and more self-storage owners and operators are enjoying smooth sailing on the green seas of revenue created by taking an aggressive approach with their tenant-insurance programs. A facility that sees $2,000 per year in tenant-insurance sales can easily earn $18,000 to $20,000 per year with a simple change in strategy that convinces more tenants to insure their belongings.

The added benefit of having more tenants who are covered by insurance is it minimizes potentially volatile situations when a multi-claim event occurs, such as a fire. In addition, its very appealing to the front-line managers who are tasked with talking to an unhappy and often emotional tenant when a claim occurs.

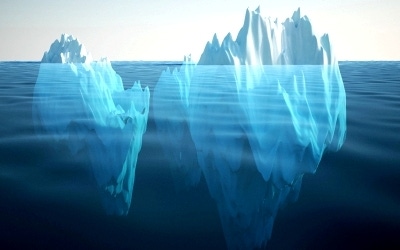

But while the seas are green and sailing is smooth today, there are icebergs on the horizon. With the latest trend toward mandatory tenant-insurance programs, customer participation is increasing dramatically. So is the exposure and risk underwritten by the insurance companies who pay the claims.

For example, in 2011, an average-size self-storage facility had tenant-insurance participation of approximately 3 percent. At a 500-unit facility with 80 percent occupancy, that meant just 12 tenants were insured. Using an average cost of $2,000 per claim, it would have meant $24,000 of exposure if the entire facility was wiped out. Low participation equaled low risk for the insurance company.

Now that self-storage operators are looking for participation of 50 percent to 70 percent, the exposure could be as high as $600,000 to $700,000 at a single location. That same insurance provider now has a very high claims exposure and could use the language in your contract to eliminate or reduce its claims payout. Youre now looking at a huge iceberg!

What Does It Really Cover?

Tenant-insurance coverages and limits are now better and higher than they were in 2011. The very best programs offer replacement-cost coverage and include catastrophic events such as earthquakes and hurricanes. Here are two items about which you should be concerned, for your sake and that of your tenants:

Will your tenants get paid in the event of a catastrophic event such as a hurricane, earthquake or large fire? (We know what tenants will assume.)

Will your tenants really be able to use the product you sold them at claim time, or will they run into an iceberg, commonly called the other insurance clause. (We know who the tenant will blame if this happens.)

A good captain will check for any potential/hidden dangers before setting sail, and you should do the same. Is your tenant-insurance provider and its reinsurance partner A.M. Best-rated? Read your providers contract to ensure there are no outs to paying your customers' claims, such as the dreaded other insurance clause. You could be facing a public-relations nightmare if a couple hundred of your tenants are forced by your tenant-insurance provider to look to any other insurance they may have (homeowners, renters, etc.) before it pays a claim. Your provider may not pay anything at all or pay a reduced amount based on depreciated valuenot good scenarios.

Your tenants expect to get what they paid for. There are good companies and products in the self-storage marketplace, and due diligence on your part will provide a quality product for you, your manager and, most important, your tenants. Will your tenant-insurance ship provide smooth sailing, or is there an iceberg ahead?

Harry Sleighel is the chairman of Storage Property Protection Inc., which provides a tenant-property-protection program for the self-storage industry, and co-founder of Michaels Wilder, an agency that provides human resources solutions and marketing services. For more information about SPP, call 877.575.7774 or visit www.storagepropertyprotection.com .

You May Also Like